Which books should I read to learn valueinvesting? And is it time to now buy since the market seems to be crashing?

问题:我应该读哪些书来学习价值投资?既然市场似乎正在崩溃,现在是时候买进了吗?

Hey guys im new to this. Im trying to learnvalue investing and I know i shoud read The intelligent investor. I am goingto. But right now i am reading one up on wall street. Question is can I do acourse on value investing? What other books should I read? Am I too late toinvest? Im 23 years old and Things went downwards which made me think that Ishould start learning how to grow. So anyone willing to help me learn? Or guideme?

嘿,伙计们,我是新来的。我在努力学习价值投资,我知道我应该读一读聪明的投资者。我要去。但现在我正在华尔街读一本。问题是我能上一门关于价值投资的课程吗?我还应该读什么书?我来不及投资了吗?我23岁了,事情变得越来越糟,这让我觉得我应该开始学习如何成长。有人愿意帮我学习吗?还是引导我?

回复

1:.The Intelligent Investor by BenjaminGraham.

本杰明格雷厄姆的《聪明的投资者》。

2. Start with The Warren Buffett Way andBuffetology.

从沃伦·巴菲特的方式和自学开始。

3. If you can, take Bruce Greenwald’s classin Columbia University. If not, read his book titled Value Investing. Also, Irecommend Joseph Calandro’s “Applied Value Investing”.

如果可以的话,去哥伦比亚大学上布鲁斯·格林沃尔德的课。如果没有,请阅读他的书《价值投资》。另外,我推荐约瑟夫·卡兰德罗的“应用价值投资”。

4. Watch some videos of Sven Karlin, he’sgreat. You can read: the little book that beats the market, the little book ofvalue investing, the intelligent investor.

看斯文·卡林的录像,他很棒。你可以读:打败市场的小书,价值投资的小书,聪明的投资者。

Calculate some example stocks/portfoliosevolving over years through some scenarios (continuous growth, bear market,recession).

计算一些股票/投资组合在某些情景(持续增长、熊市、衰退)中多年来的变化。

But in the end it will take some time toget used to taking risks with your money. I started with 1k and just boughtstocks of a few decent companies I felt familiar with (circle of confidence)and got to know different elements of investing like dividends, seeing thestock prices go up and down, losing some, gaining some.

但最终还是需要一些时间来适应用你的钱冒险。我从1k开始,刚买了几家我觉得熟悉的不错的公司(信心圈)的股票,了解了投资的不同元素,比如分红,看到股价上下波动,损失一些,获得一些。

5. You should learn the basics. Althoughthe Intelligent Investor is the bible for value investors, it’s not much usefulif you can’t understand the terminology. A book I strongly suggest you startingwith is “Value investing for dummies”, the title may seemunderwhelming, but it’s basically a 150 page crash course about everything youneed to know about investing (I part of the book) and more specifically valueinvesting(II part of the book). Right now the market seems to be going througha , -11% or something for some indexes, expect the following days todip even lower, for value investor this means that there is a bargain and youcan buy for a price which is more coherent with its intrinsic value. Sobasically yes, this is the golden opportunity to start investing.

你应该学习基本知识。虽然聪明的投资者是价值投资者的圣经,但如果你不懂这个术语,它就没什么用处了。我强烈建议你从“傻瓜的价值投资”开始读这本书,书名可能显得不起眼,但它基本上是一个150页的速成课程,内容是你需要知道的关于投资的一切(本书的一部分)和更具体的价值投资(本书的二部分)。现在市场似乎正在经历 一些指数预计未来几天会进一步下探,-11%左右,对于价值投资者来说,这意味着存在一个讨价还价的机会,你可以以更符合其内在价值的价格买入。所以基本上是的,这是开始投资的黄金机会。

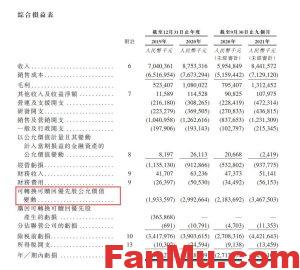

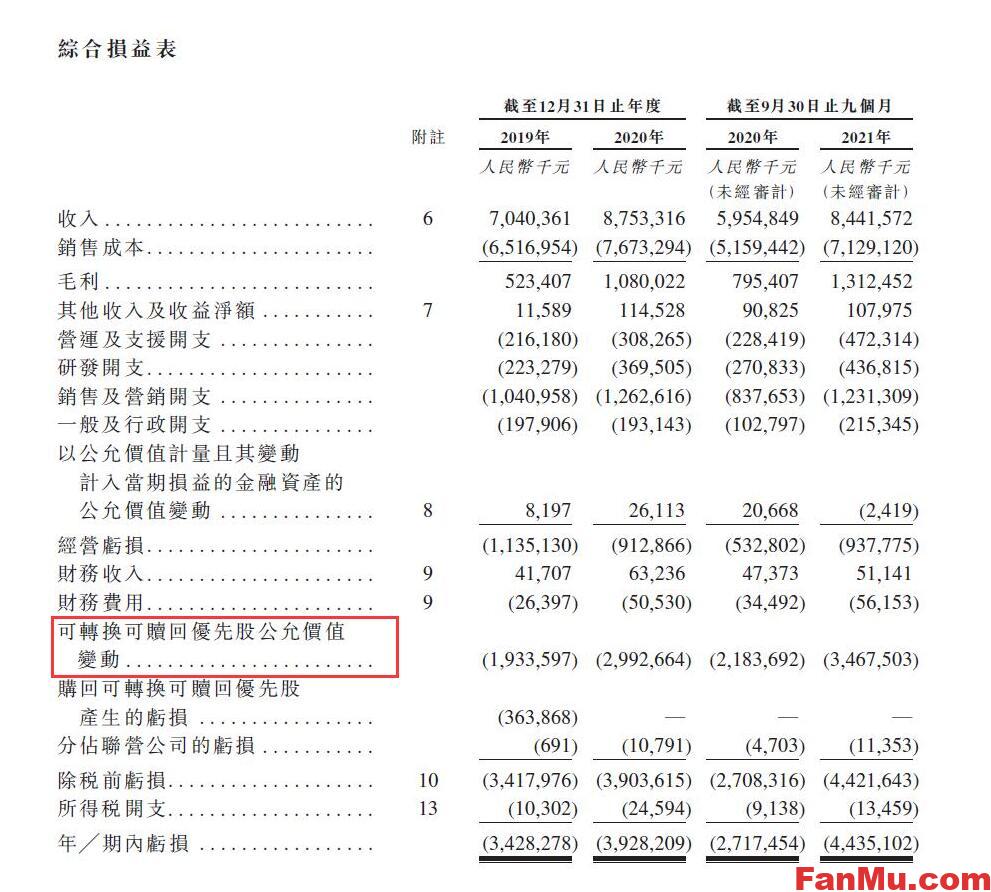

6. If you don’t have any experience and donot know how to proceed with researching on company’s financial statements, myadvice is not to buy shares from any company and do not follow what others do.Stay disciplined and until you grasp enough knowledge I suggest you investingin mutual funds related to value investing. You can find many by researching onthe internet. Of course you are going to need time (at least 1 year). Don’t bein a rush, knowledge is more important than money. The more knowledge you have,the more opportunities you will have to make money.

如果你没有任何经验,也不知道如何继续研究公司的财务报表,我的建议是不要从任何公司购买股票,也不要听从别人的做法。保持自律,在你掌握足够的知识之前,我建议你投资与价值投资相关的共同基金。你可以在网上找到很多。当然你需要时间(至少一年)。不要着急,知识比金钱更重要。知识越多,赚钱的机会就越多。

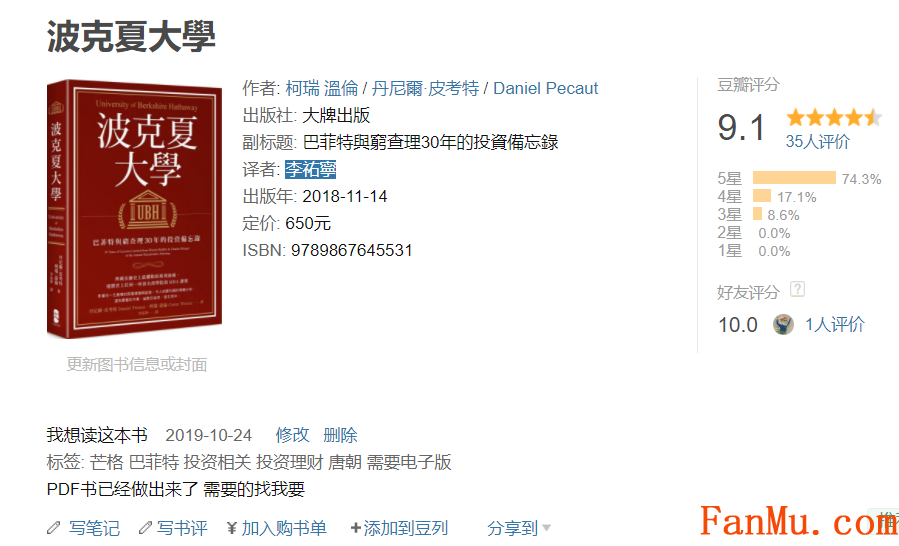

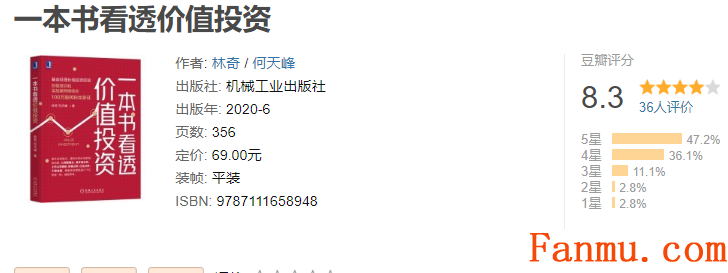

我们的建议先从张新民的财务报表开始,然后聪明的投资者,然后巴菲特致股东信,这样你就差不多入门了,其余修行看自己了。

暂无评论内容