![图片[1]_查理·芒格:2021每日日报年会会议记录_繁木网](http://fanmu.com/wp-content/uploads/2021/12/d14f1a783d3b-1.png)

Charlie Munger: 2021 Daily Journal Annual Meeting Transcript

查理·芒格:2021每日日报年会会议记录

Read the full transcript of the meeting featuring Charlie Munger and Gerald Salzman.

阅读查理·芒格和杰拉尔德·萨尔兹曼的会议记录全文。

Charlie Munger at the 2021 Daily Journal annual meeting spoke once again at great length. At the age of 97, Charlie Munger was—not surprisingly—sharp as a tack. At this rate, he’ll likely (hopefully) reach the longevity of Irving Kahn.

查理·芒格在2021年《每日日报》年会上再次作了长篇大论的发言。在97岁的时候,查理·芒格并不出奇的犀利。以这样的速度,他很可能(希望)达到欧文·卡恩的寿命。

The meeting was held on February 24, 2021. And like last year, you will in this note find a full transcript of the entire meeting.

会议于2021年2月24日举行。和去年一样,你会在这张纸条上找到整个会议的完整记录。

Enjoy!

好好享受!

Charlie Munger: Ladies and gentlemen, wherever you are, via Yahoo finance’s website. The meeting will come to order.

查理·芒格:女士们先生们,无论你们在哪里,都可以通过雅虎财经的网站。会议就要开始了。

I’m Charlie Munger, Chairman, and to my right is Jerry Salzman, CEO.

我是主席查理·芒格,右边是首席执行官杰里·萨尔兹曼。

The directors are Gerry Salzman, Peter Kaufman, Mary Conlin, Gary Wilcox—who’s retiring now—and myself. Ellen Ireland will be inspector of elections.

导演是格里·萨尔兹曼、彼得·考夫曼、玛丽·康林、加里·威尔科克斯和我自己。埃伦爱尔兰将担任选举监察员。

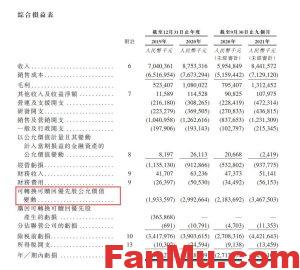

On December 18, 2020—the record date—there were 1,380,746 shares of common stock of the company outstanding. The total number of shares, represented by proxies at this meeting, are 995,682, which are more than enough to constitute a quorum making the meeting duly held. The first order of business is to reelect the four directors and the votes are as follows: Charles Munger, 679,481, Gerald Salzman, 660,287, Peter Kaufman, 593,336, Mary Conlon, 651,493. Because we have the proxies those directors are now reelected.

在记录日期2020年12月18日,本公司的普通股流通股为1380746股。本次会议由代理人代表的股份总数为995682股,足以构成正式召开会议的法定人数。第一步是重新选举四位董事,投票结果如下:查尔斯·芒格,679481,杰拉尔德·萨尔兹曼,660287,彼得·考夫曼,593336,玛丽·康伦,651493。因为我们有代理人这些董事现在连任。

The second proposal is to ratify the appointment of our certified public accountant: Baker Tilly US, LLP. The votes in favor of that are 995,356 against 120. That’s interesting—who in the hell is voting against the accountants? But the accountants are duly elected. We will now proceed to the question period.

第二项建议是批准任命我们的注册会计师:天职国际会计师事务所。赞成票是995356票对120票。真有趣,到底谁在投票反对会计?但是会计师是正式选举出来的。我们现在进入提问阶段。

Go ahead.

前进。

Questions

问题

Question: In this year’s annual letter, you mentioned the share price increase was driven by speculative frenzy and forced index buying. I would imagine that applies to the broad market too. What are the psychological implications of this type of market behavior? What could investors do to cope better with periodical frenzy?

问:在今年的年报信中,你提到股价上涨是由投机狂热和被迫购买指数推动的。我想这也适用于广阔的市场。这种市场行为的心理暗示是什么?投资者能做些什么来更好地应对周期性的狂热?

Charlie Munger: Well, these things do happen in a market economy. You get crazy booms. Remember the Dot Com boom when every little building in Silicon Valley ran into a huge price and a few months later about a third of them were vacant. There are these periods in capitalism. I’ve been around for a long time and my policy has always been to just write them out. And I think that’s what shareholders do.

查理·芒格:嗯,这些事情在市场经济中确实发生过。你会得到疯狂的隆隆声。还记得互联网繁荣时期吗?当时硅谷的每一栋小楼都涨价了,几个月后,大约有三分之一的房子空置了。资本主义有这样的时期。我已经在这里呆了很长时间了,我的政策一直是把它们写出来。我认为股东就是这么做的。

In fact, what a lot of shareholders actually do is crowd in buying stocks on frenzy—frequently on credit—because they see that they’re going up. And, of course, that’s a very dangerous way to invest. I think that shareholders should be more sensible and not crowd into stocks and buy them just because they’re going up and they like to gamble.

事实上,很多股东实际上都在疯狂地买进股票,因为他们看到股票在上涨。当然,这是一种非常危险的投资方式。我认为股东们应该更加明智,不要仅仅因为股价上涨、喜欢赌博就挤进股市买入。

Kipling once wrote a poem called The Women (The Ladies) and the concluding line was to the effect that you should learn about women from him instead of doing it yourself, because, he says, I know you won’t follow my advice.

吉卜林曾经写过一首诗,叫做《女人》(TheWomens),最后一句话的大意是,你应该向他学习关于女人的知识,而不是自己去做,因为,他说,我知道你不会听从我的建议。

Question: What are Mr. Munger’s thoughts on the recent GameStop short squeeze by social media and the resulting implications on short selling in the future? And another shareholder asked: Dear Mr. Munger, please share your thoughts on the recent /r/WallStreetBets GameStop short squeeze. It seems to involve a lot of your standard causes of human misjudgment.

问:芒格对最近社交媒体的GameStop卖空行为以及由此产生的对未来卖空行为的影响有何看法?另一位股东问道:亲爱的芒格先生,请分享您对最近/r/WallStreetBets GameStop卖空的看法。这似乎涉及到你的许多标准的人类错误判断的原因。

Charlie Munger: Well, it certainly does and that’s the kind of thing that can happen when you get a whole lot of people who are using liquid stock markets to gamble the way they would on embedding on resources.

查理·芒格:好吧,确实是这样,当你让很多人利用流动性股票市场,像投资资源那样赌博时,就会发生这种情况。

And that’s what we have going in the stock market in a frenzy that’s fed by people who are getting commissions and other revenues out of this new bunch of gamblers.

而这正是我们在股市中所经历的疯狂,是由那些从这群新赌徒身上获得佣金和其他收入的人所助长的。

And, of course, when things get extreme you have things like that short squeeze. It’s not generally noticed by the public but clearinghouses clear all these trades. And when things get as crazy as they were in the event you’re talking about, there are threats of clearinghouse failure. So it gets very dangerous. And it’s really stupid to have a culture that encourages as much gambling in stocks by people who have the mindset of race track betters. And, of course, it’s going to create trouble as it did.

当然,当事情变得极端的时候,你会有类似于短时间挤压的情况。公众一般不会注意到这一点,但清算所会清理所有这些交易。当事情变得像你所说的那样疯狂的时候,就会有清算所失败的威胁。所以它变得非常危险。而且,如果一种文化鼓励那些有赛道投手心态的人在股票上进行同样多的赌博,那真的很愚蠢。当然,这也会制造麻烦。

I have a very simple idea on the subject. I think you should try and make your money in this world by selling other people things that are good for them. And if you’re selling them gambling services where you make profits off of the top, like many of these new brokers who specialize in luring the amateurs in, I think it’s a dirty way to make money. And I think that we’re crazy to allow it.

关于这个问题我有一个非常简单的想法。我认为你应该试着在这个世界上通过向别人出售对他们有益的东西来赚钱。如果你向他们出售赌博服务,从中牟取暴利,就像许多专门引诱业余爱好者的新经纪人一样,我认为这是一种肮脏的赚钱方式。我认为我们允许这样做是疯了。

Question: What do you hope the future of the Daily Journal Corporation looks like in a decade?

问:你希望日报社在十年后的未来是什么样子?

Charlie Munger: Well, I certainly hope that they succeed mightily in their software endeavor to automate all these courts for the modern world. And, I think that could happen, but, of course, that’s not a sure thing. I hope the newspaper survives too. And that’s not a sure thing either.

查理·芒格:嗯,我当然希望他们在软件方面取得巨大成功,为现代世界自动化所有这些法庭。而且,我认为这可能发生,但是,当然,这不是一个确定的事情。我希望报纸也能生存下来。这也不是一件确定的事情。

Question: The highly configurable JTI product may help e-suites integrate deeply into new jurisdictions as agencies and citizens become familiar with the courthouse software. Today, the majority of contractual revenue that can be identified is from implementations and licenses. What are the main sources of ancillary revenue expected once the products have gone live and how meaningful will the products like eFile-it, ePay-it, cloud hosting services, and others become?

问:随着机构和公民对法院软件的熟悉,高度可配置的JTI产品可能有助于电子套房深入融入新的司法管辖区。今天,可以确定的大部分合同收入来自实现和许可证。一旦产品上线,预计辅助收入的主要来源是什么?像eFile it、ePay it、云托管服务等产品的意义有多大?

Charlie Munger: Well, we don’t really know where it’s all going. We do know one thing and that is that the courts of the whole world are going to be taken into the modern age. And, as Gerry has just said to me just after breakfast, you wouldn’t want to invest in a parking lot by a courthouse for the future because an awful lot of the court proceedings are going to go to the internet. This is a highly desirable thing. If you go to a little country like Estonia, the whole damn country is on the internet and it’s a very good idea.

查理·芒格:好吧,我们真的不知道这一切的走向。我们知道一件事,那就是全世界的法院都将进入现代。而且,正如格里刚吃完早饭对我说的,你不会想在未来投资法院的停车场,因为大量的诉讼程序都会传到互联网上。这是一件非常令人向往的事情。如果你去爱沙尼亚这样的小国家,整个该死的国家都在互联网上,这是一个非常好的主意。

So, I think you can count on the fact that what we’re doing is going to be a big growing field. That’s the good news. The bad news is it’s not clear who’s gonna win all the business or how much money is going to be made. Generally speaking, people assume that we’re a normal software company like Microsoft or something. We are in fact being a more difficult type of software business than Microsoft. When you respond to software by the RFP process, it’s a very difficult, demanding business and it’s less profitable and less sure than what Microsoft does. We love it anyway. It’s doing a big public service.

所以,我想你可以相信,我们正在做的将是一个巨大的增长领域。这是个好消息。坏消息是,现在还不清楚谁会赢得所有的生意,也不清楚能赚多少钱。一般来说,人们认为我们是一个像微软之类的普通软件公司。事实上,我们是一个比微软更困难的软件企业。当您通过RFP流程对软件作出响应时,这是一项非常困难、要求很高的业务,而且它的利润较低,而且比微软的业务更不确定。不管怎样我们都喜欢。它正在做一个大的公共服务。

Question: We have a couple of questions about J.P. “Rick” Guerin. Would you share a few stories about him and your fondest memory?

问:我们有几个关于J.P.“里克”盖林的问题。你能分享一些关于他的故事和你最美好的回忆吗?

Charlie Munger: Well, he was one of my closest friends for many decades. And, he was very good company and a splendid gentleman. Of course, we accomplished quite a bit working together.

查理·芒格:他是我几十年来最亲密的朋友之一。而且,他是一个很好的伙伴和一个出色的绅士。当然,我们在一起完成了不少工作。

Rick was part of the group which consisted of Warren Buffett, Rick Guerin, and Charlie Munger that bought control of Blue Chip Stamps when it was widely distributed in an anti-trust settlement. We were together in that for a long, long time, and then Rick and I did the Daily Journal together on another occasion.

里克是沃伦•巴菲特、里克•盖林和查理•芒格(Charlie Munger)组成的集团的一员,他们购买了蓝筹股的控制权,当时蓝筹股在反垄断协议中被广泛发行。我们在一起很长很长时间了,然后我和里克在另一个场合一起写日记。

Rick was always humorous. Always intelligent. I tell a story on Rick that he took the Navy’s IQ test and got one of the highest scores ever recorded and left early. That doesn’t happen. That’s the reason he rose so fast in life. He was just so damn smart.

里克总是很幽默。总是很聪明。我讲了一个关于瑞克的故事,他参加了海军的智商测试,得到了有史以来最高的分数之一,并提前离开了。那不会发生。这就是为什么他在生活中起得这么快。他太聪明了。

He was fun to be with because he was always jumping out of airplanes and parachutes and running marathons and so on, doing all kinds of things I would never consider doing. And he was a great kidder. He loved to kid people.

和他在一起很有趣,因为他总是跳出飞机、跳伞、跑马拉松等等,做各种我从未想过要做的事情。他是个好孩子。他喜欢跟人开玩笑。

He was very courageous and generous in helping everybody around him all his life. We miss Rick terribly. But he was 90 years of age. He had a long and wonderful run. He was old as I am. When these people go, there is none replacing them. Gerry, can you ever remember Rick down? He was always upbeat.

他一辈子都很勇敢、慷慨地帮助身边的每一个人。我们非常想念瑞克。但他已经90岁了。他跑得又长又精彩。他和我一样老。当这些人走了,没有人能代替他们。格瑞,你还记得瑞克·唐恩吗?他总是很乐观。

Gerald Salzman: Always upbeat, yes. And interested and up to speed and didn’t have to take a lot of time to get background information to make his comments. Always on point.

杰拉尔德·萨尔兹曼:总是乐观的,是的。他很感兴趣,也很迅速,不需要花太多时间来获取背景信息来发表评论。始终正确。

Charlie Munger: Well, it helps to be able to leave the IQ test early with the highest score.

查理·芒格:嗯,能以最高的分数提前离开智商测试是有帮助的。

Questions: Now that we are cash flow positive—assuming the software business is investing organically as much as it can—what is the philosophical thinking with respect to capital allocation at the Daily Journal. Are traditional dividends and share repurchases the likely end-state—assuming our software business grows into a bonafide company—or will buying and holding securities from time to time be what the board is comfortable with? Everyone knows this isn’t a small cap Berkshire Hathaway. I’m just trying to get a feel for what the long-term capital allocation is.

问题:既然我们的现金流是正的,假设软件业务正在尽可能多地进行有机投资,《每日邮报》关于资本分配的哲学思考是什么。假设我们的软件业务发展成为一家真正的公司,传统的股息和股票回购是可能的最终状态吗?或者,董事会会是否愿意不时购买和持有证券?大家都知道这不是伯克希尔哈撒韦的小盘股。我只是想了解一下长期资本配置是什么。

Charlie Munger: Well, the business around here that has the most promise is our software business automating the courts. And we’re gonna play that as hard as we can. And, we hope to do well in it. [As for] marketable securities, we prefer owning common stocks to holding cash under current conditions and it’s kind of an accident that we have so much in marketable securities.

查理·芒格:嗯,这里最有前途的业务是我们的软件业务,自动化法庭。我们会尽全力的。而且,我们希望在这方面做得好。[至于]有价证券,在目前的情况下,我们更喜欢持有普通股而不是持有现金,我们有这么多有价证券是一种意外。

Question: In recent years, Berkshire Hathaway has provided much greater insight into the company’s succession thoughts and has made available at the annual meeting the company’s leading managers that will steer Berkshire’s future. These actions have given some shareholders more visibility and comfort on their investment. Can you provide similar insight regarding the future at the Daily Journal and would you consider implementing policies like those at Berkshire so shareholders can get to know the up-and-coming leaders in the organization?

问:近年来,伯克希尔哈撒韦公司对公司的接班人思想有了更深入的了解,并在年会上公布了公司的主要管理人员,他们将指导伯克希尔的未来。这些举措让一些股东在投资上更具知名度和舒适度。你能在《每日邮报》上提供类似的关于未来的见解吗?你会考虑执行伯克希尔那样的政策吗?这样股东们就能了解公司里的后起之秀?

Charlie Munger: Well, the people doing the computer software are doing magnificently well—the people under Gerry: Maryjo and Danny. We hope they’ll continue doing magnificently well. But, of course, it’s a very difficult field. There’s a lot of competition and we’re a very small company compared to our main competitor. And so, we can’t promise we’re going to succeed. All we can promise is that we’re gonna try and so far as I can tell, we’re doing pretty well. Gerry, don’t you think we’re doing pretty well?

查理·芒格:好吧,做电脑软件的人做得非常好,在格里领导下的人:玛丽·乔和丹尼。我们希望他们能继续表现出色。当然,这是一个非常困难的领域。竞争非常激烈,与我们的主要竞争对手相比,我们是一家非常小的公司。所以,我们不能保证我们会成功。我们所能保证的就是我们会努力,据我所知,我们做得很好。格瑞,你不觉得我们做得很好吗?

Gerald Salzman: I think so, Charlie.

杰拉尔德·萨尔兹曼:我想是的,查理。

Charlie Munger: I would go further. I don’t think Gerry is surprised that the people doing the work—Maryjo and Danny—are doing well. But I’m flabbergasted at how well they’re doing.

查理·芒格:我会更进一步。我不认为格里对做工作的人玛莉乔和丹尼做得很好感到惊讶。但我对他们的表现感到震惊。

Gerald Salzman: Charlie refers to the courts, many times. The JTI software has been configured for other judicial and justice agencies, including district attorneys, prosecutors, public defenders, probation, etc. So we have one basic system configured in a number of different ways, including worker’s comp for a large state in the United States.

杰拉尔德萨尔兹曼:查理提到法院,很多次。JTI软件已为其他司法和司法机构配置,包括地区律师、检察官、公设辩护人、缓刑等。因此,我们有一个基本系统,以多种不同的方式配置,包括美国一个大州的工人薪酬。

Charlie Munger: It’s a huge field in which we have a very interesting toehold with the strongest toeholds in Australia and California. We can’t promise what the outcome will be but we are trying pretty hard and we get some favorable impressions of progress. One thing I can promise is that I won’t contribute much to it because I don’t understand it.

查理芒格:这是一个巨大的领域,我们有一个非常有趣的立足点与最强的立足点在澳大利亚和加利福尼亚州。我们不能保证会有什么结果,但我们正在努力,取得了一些进展的良好印象。我可以保证的一件事是,我不会为它贡献太多,因为我不了解它。

Questions: Many observers see market behavior that reminds them of the Dot Com bubble: wild speculation, endless SPACs, and IPOs soaring on their first day of trading. Do you agree that there is a close parallel to the late 90s and that this, therefore, “must end badly?”

问题:许多观察家看到的市场行为让他们想起了网络泡沫:疯狂的投机、无休止的SPAC,以及上市首日飙升的IPO。你是否同意与90年代末有着密切的平行关系,因此这“一定会以糟糕的结局告终”?”

Charlie Munger: Yes, I think it must end badly but I don’t know when.

查理·芒格:是的,我想结局一定很糟,但我不知道什么时候。

Question: It seems like everyone—including actors, athletes, singers, and politicians—is getting into the business of promoting their own SPAC. What do you think of all of the SPACs and the promoters pushing them?

问:似乎每个人,包括演员、运动员、歌手和政客,都在投身于推销自己的SPAC。你怎么看所有的SPAC和促销员推他们?

Charlie Munger: Well, I don’t participate at all. And I think the world would be better off without them. I think this kind of crazy speculation in enterprises not even found or picked out yet is a sign of an irritating bubble. It’s just that the investment banking profession will sell shit as long as shit can be sold.

查理·芒格:嗯,我根本不参加。我认为没有他们世界会更好。我认为,这种疯狂的投机行为甚至还没有被发现或挑选出来,这是一个令人恼火的泡沫的迹象。只是,只要狗屎能卖出去,投资银行业就会卖狗屎。

Question: Last February, you spoke about the wretched excess in the financial system. Given the developments over the past year, could you give us an update on your assessment of wretched excess in the system? Where does it appear most egregious?

问:去年2月,你谈到了金融体系严重过剩的问题。鉴于过去一年的事态发展,你能否向我们介绍一下你对金融体系严重过剩的最新评估?它在哪里显得最离谱?

Charlie Munger: Well, it’s most egregious in the momentum trading by novice investors lured in by new types of brokerage operations like Robinhood. I think all of this activity is regrettable. I think civilization would do better without it.

查理·芒格:在动量交易中,最令人震惊的是被罗比尼奥这样的新型经纪业务所吸引的新手投资者。我认为所有这些活动都是令人遗憾的。我认为没有它文明会更好。

You’ll remember that when the first big bubble came, which was the South Sea bubble in England back in the 1700s, it created such havoc eventually when it blew up that England didn’t allow hardly any public trading and securities of any companies for decades thereafter. It just created the most unholy mess.

你会记得,当第一个大泡沫出现时,也就是17世纪英国的南海泡沫,它最终造成了巨大的破坏,当泡沫破灭时,英国在此后的几十年里几乎不允许任何公司进行任何公开交易和证券交易。它只是制造了最邪恶的混乱。

So human greed and the aggression of the brokerage community create these bubbles from time to time. And I think wise people should just stay out of them.

因此,人类的贪婪和经纪行业的侵略性不时制造出这些泡沫。我认为聪明人应该远离他们。

Question: In your past speeches, you have mentioned the term functional equivalent of embezzlement to describe situations where bubbles can form because both parties involved in a bubble believe the asset to be worth more than it truly is. Can U.S. Treasury bonds be such a case today? And what are the implications, since Treasury assets underpin the value of every other asset? Thank you for all you do to educate us.

问:在你过去的演讲中,你提到了“功能相当于盗用”一词,用来描述泡沫可能形成的情况,因为泡沫中的双方都认为资产的价值高于实际价值。美国国债今天会是这样吗?既然国库资产支撑着其他所有资产的价值,那么这意味着什么呢?谢谢你为教育我们所做的一切。

Charlie Munger: Well no, I don’t think we have a bubble in Treasury securities. I think they’re a bad investment when interest rates are this low. I never buy any and neither does Daily Journal. But, no, I don’t think Treasury securities are a big problem.

查理·芒格:嗯,不,我认为美国国债没有泡沫。我认为当利率这么低的时候,他们是一个糟糕的投资。我从不买任何东西,日报也不买。但是,不,我不认为国库券是个大问题。

I do think that we don’t know what these artificially low interest rates are going to do or how the economy is going to work in the future as governments print all this extra money. The only opinion I have there is that I don’t think anybody knows what’s going to happen for sure. Larry Summers has recently been quoted as being worried that we’re having too much stimulus. And I don’t know whether he’s right or not.

我确实认为,我们不知道这些人为压低的利率会有什么作用,也不知道随着政府印这些额外的钱,未来经济会如何运转。我唯一的看法是,我认为没有人确切知道会发生什么。拉里·萨默斯最近被引述说,他担心我们的经济刺激计划太多了。我不知道他是不是对的。

Question: Previously, you have said; It takes character to sit with all that cash and do nothing. I didn’t get to where I am by going after mediocre opportunities. In the past few years, equity prices have increased significantly and cash has arguably become riskier due to central banking policy. Have you considered amending this quote or lowering your standards?

问:你以前说过,有那么多钱坐着什么也不做需要性格。我不是靠追求平庸的机会才达到现在的状态的。在过去的几年里,由于央行的政策,股票价格大幅上涨,现金的风险也越来越大。你考虑过修改这个报价或降低你的标准吗?

Charlie Munger: I think everybody is willing to hold stocks at higher price-earnings multiples when interest rates are as low as they are now. And so I don’t think it’s necessarily crazy that good companies sell at way higher multiples than they used to.

查理·芒格:我认为当利率像现在这样低的时候,每个人都愿意以更高的市盈率持有股票。所以我认为,好公司的销售倍数比过去高,这不一定是疯狂的。

On the other hand, as you say, I didn’t get rich by buying stocks at high price-earnings multiples in the midst of crazy speculative booms. I’m not going to change. I am more willing to hold stocks at high multiples than I would be if interest rates were a lot lower. Everybody is.

另一方面,正如你所说,我并不是在疯狂的投机热潮中以高市盈率买进股票而致富的。我不会改变的。我更愿意以高倍数持有股票,而不是利率低得多。每个人都是。

Question: Do you think value investing is still relevant in a GDP-decreasing world? And, what about passive investing?

问:你认为在一个GDP不断下降的世界里,价值投资仍然有意义吗?那么,被动投资呢?

Charlie Munger: Well, that is easy. Value Investing will never go out of style. Because value investing—the way I conceive it—is always wanting to get more value than you pay for when you buy a stock. That approach will never go out of style.

查理·芒格:嗯,那很简单。价值投资永远不会过时。因为按照我的设想,价值投资总是希望得到比你买股票时付出的更多的价值。这种方法永远不会过时。

Some people think that value investing is you chase companies that have a lot of cash and they’re in a lousy business or something. I don’t define that as value investing. I think all good investing is value investing. It’s just that some people look for values in strong companies and some look for values in weak companies. Every value investor tries to get more value than he pays for.

有些人认为价值投资就是你追逐那些有大量现金的公司,而他们的生意很糟糕。我不把它定义为价值投资。我认为所有好的投资都是价值投资。只是有些人在强势公司寻找价值,有些人在弱势公司寻找价值。每个价值投资者都试图获得比他付出的更多的价值。

What is interesting is that in wealth management, a lot of people think that if they have a hundred stocks they’re investing more professionally than they are if they have four or five. I regard this as insanity. Absolute insanity.

有趣的是,在财富管理领域,很多人认为,如果他们有一百只股票,他们的投资就比他们有四五只股票时更专业。我认为这是疯了。完全疯了。

I find it much easier to find four or five investments where I have a pretty reasonable chance of being right that they’re way above average. I think it’s much easier to find five than it is to find a hundred.

我发现要找到四到五项投资要容易得多,因为我有相当合理的机会证明它们远远高于平均水平。我认为找五个比找一百个容易得多。

I call it deworsification—which I copied from somebody. I’m way more comfortable owning two or three stocks which I think I know something about and where I think I have an advantage.

我称之为我从别人那里抄来的。我更喜欢持有两三只股票,我认为我知道一些东西,我认为我有优势。

Question: Why is Berkshire Hathaway selling shares of Wells Fargo as quickly as one can and the Daily Journal has sold one share? If it’s not good enough for Berkshire, shouldn’t we have the same standards?

问:为什么伯克希尔哈撒韦公司(Berkshire Hathaway)以最快的速度出售富国银行(Wells Fargo)的股票,而《每日邮报》(Daily Journal)却卖出了一股?如果对伯克希尔来说还不够好,我们不应该有同样的标准吗?

Charlie Munger: Well, I don’t think it’s required that we be exactly the same on everything. We have different tax considerations. There’s no question about the fact that Wells Fargo has disappointed long-term investors like Berkshire because the old management—which is now removed—were not consciously malevolent or thieving but they had terrible judgment in having a culture of cross-selling where the incentives on the poorly paid employees were too great to sell stuff that customers didn’t really need. And when the evidence came in that the system wasn’t working very well because some of the employees were cheating some of the customers, they came down hard on the customers instead of changing the system. That was a big error in judgment. And, of course, it’s regrettable.

查理·芒格:嗯,我不认为要求我们在每件事上都一模一样。我们有不同的税务考虑。毫无疑问,富国银行已经让伯克希尔这样的长期投资者失望了,因为现在被撤职的老管理层并不是有意识地恶意或偷盗,但他们在交叉销售的文化中有着糟糕的判断力,在这种文化中,对低收入员工的激励太大,以至于无法销售东西客户并不真正需要的。当有证据表明,由于一些员工欺骗了一些客户,系统运行得不太好时,他们非但没有改变系统,反而狠狠地打击了客户。那是一个很大的判断错误。当然,这是令人遗憾的。

So, you can understand why Warren got disenchanted with Wells Fargo. I think I’m a little more lenient. I expect less out of bankers than he does.

所以,你可以理解为什么沃伦对富国银行不再抱有幻想。我觉得我宽容一点。我对银行家的期望比他低。

Question: What is the wisdom behind holding bank stocks compared to other stocks. Are they more stable?

问:与其他股票相比,持有银行股背后的智慧是什么。他们更稳定吗?

Charlie Munger: Well, I think all stocks can fluctuate. I do think banking run intelligently is a very good business. But, a very wise man said on an earlier occasion: The trouble with banking is that we have more banks than we have bankers.

查理·芒格:嗯,我认为所有的股票都会波动。我认为明智地经营银行业是一项非常好的业务。但是,一位非常聪明的人在早些时候说过:银行业的问题在于,我们拥有的银行比我们拥有的银行家还要多。

The kind of executives who have a Buffett-like mindset and never get in trouble are a minority group, not a majority group. It’s hard to run a bank intelligently. There’s a lot of temptation to do dumb things which will make the earnings next quarter go up but are bad for the long term. And some bankers yield to the temptations. It’s difficult, but it’s not impossible investing in bank stocks successfully.

那种拥有巴菲特式思维、从不惹麻烦的高管是少数群体,而不是多数群体。聪明地经营银行很难。有很多诱惑去做一些愚蠢的事情,这会让下个季度的收益上升,但从长远来看是不好的。一些银行家屈服于诱惑。很难,但成功投资银行股并非不可能。

Question: What is the biggest competitive threat to U.S. banks like Bank of America and US Bank—both equity holdings of the Daily Journal Corporation—over the long term? Is it digital wallets like PayPal, Square, or Apple Pay? Is it Bitcoin, decentralized finance, or something else?

问:对美国银行(如美国银行和美国银行)来说,长期持有日刊公司(Daily Journal Corporation)股权的最大竞争威胁是什么?是像PayPal、Square还是Apple Pay这样的数字钱包?是比特币、分散化金融还是别的什么?

Charlie Munger: Well, I don’t think I know exactly what the future of banking is and I don’t think I know how the payment system will evolve. I do think that a properly run bank is a great contributor to civilization and that the central banks of the world like controlling their own banking system and their own money supplies.

查理·芒格:嗯,我不知道银行业的未来是什么,也不知道支付系统将如何发展。我确实认为,一家经营得当的银行是文明的伟大贡献者,世界各国央行喜欢控制自己的银行体系和货币供应。

So, I don’t think Bitcoin is going to end up as the medium of exchange for the world. It’s too volatile to serve well as a medium of exchange. It’s really kind of an artificial substitute for gold, and since I never buy any gold, I never buy any Bitcoin. I recommend that other people follow my practice. Bitcoin reminds me of what Oscar Wilde said about fox hunting. He said it was the pursuit of the uneatable by the unspeakable.

所以,我不认为比特币最终会成为世界交换的媒介。它太不稳定了,不能很好地作为交换媒介。它实际上是一种人造的黄金替代品,因为我从不买黄金,所以我从不买比特币。我建议其他人遵循我的做法。比特币让我想起了奥斯卡王尔德所说的猎狐。他说,这是无法形容的人对无法形容的人的追求。

Question: Has your opinion on cryptocurrencies remained the same? And would the Daily Journal consider Bitcoin or any other cryptocurrency as an asset on the balance sheet similar to what Tesla recently did?

问:您对加密货币的看法是否保持不变?《每日邮报》是否会将比特币或其他加密货币视为资产负债表上的一项资产,与特斯拉最近的做法类似?

Charlie Munger: We will not be following Tesla into bitcoin.

查理·芒格:我们不会跟随特斯拉进入比特币。

Question: BYD is in the Daily Journal stock portfolio with a very big paper gain. The stock has gained so much this year and last year. The stock appreciated probably way more than intrinsic value. How do you decide to hold on to a stock or sell some?

问:比亚迪在日刊股票投资组合中的账面收益非常大。这只股票今年和去年都涨了很多。股票的升值幅度可能远远超过了内在价值。你是如何决定持有一只股票还是卖出一些?

Charlie Munger: Well, that’s a very good question. BYD stock did nothing for the first five years we held it. Last year it quintupled. What happened is that BYD is very well positioned for the transfer of Chinese automobile production from gasoline-driven cars to electricity-driven cars. You can imagine it’s in a wonderful position and that excited the people in China which has its share of crazy speculators. And so, the stock went way up.

查理·芒格:这个问题问得很好。在我们持有比亚迪股票的头五年里,它什么也没做。去年增长了五倍。事实上,比亚迪在中国汽车生产从汽油驱动汽车向电动汽车转移方面处于非常有利的地位。你可以想象它处于一个非常好的位置,这让中国人民兴奋不已,因为中国也有疯狂的投机者。所以,股票一路走高。

We admire the company and like its position. And we pay huge taxes to a combination of the federal government and the state of California when we sell something. On balance, we hold in certain of these position when, normally, we wouldn’t buy a new position. Practically everybody does that.

我们钦佩这家公司,也喜欢它的地位。当我们卖东西的时候,我们要向联邦政府和加利福尼亚州的联合政府缴纳巨额税款。总的来说,当我们通常不买新的头寸时,我们持有其中的某些头寸。实际上每个人都这么做。

One of my smartest friends in venture capital is constantly getting huge clumps of stocks at nosebleed prices. And what he does is he sells about half of them always. That way, whatever happens, he feels smart. I don’t follow that practice but I don’t criticize it either.

我在风险投资界最聪明的朋友之一,就是不断以令人流鼻血的价格买进大量股票。他所做的是他总是卖一半。这样,不管发生什么,他都觉得自己很聪明。我不遵循这种做法,但我也不批评它。

Question: Do you believe the valuations for electric car manufacturers are in bubble territory? Both Berkshire and Li Lu own BYD Company which you spoke highly of in the past. BYD sells at nearly 200 P/E. This is cheap compared to Tesla currently valued at over 1100 times P/E and 24 times sales. I know Berkshire is a long-term owner and rarely sells securities of high-quality companies it owns in its portfolio simply because it’s overvalued. For example, Coca-Cola in the past. However, is there a price too high that the company’s future profits simply cannot justify? And since we are on the subject of selling potentially overvalued security, could you provide your systems for selling securities?

问:你认为电动汽车制造商的估值处于泡沫区间吗?伯克希尔和李路都拥有比亚迪公司,你过去曾高度评价过这家公司。比亚迪的市盈率接近200倍,与特斯拉目前市盈率超过1100倍、销售额达到24倍的价格相比,比亚迪的售价很便宜。我知道伯克希尔是一个长期的拥有者,很少出售其投资组合中的高质量公司的证券,仅仅是因为它被高估了。例如,过去的可口可乐。然而,有没有一个价格太高,公司未来的利润根本无法证明?既然我们的主题是出售可能估值过高的证券,您能提供您的证券销售系统吗?

Charlie Munger: Well, I so rarely hold a company like BYD that goes to a nosebleed price that I don’t think I’ve got a system yet. I’m just learning as I go along. I think you can count on the fact that if we really like the company and we like the management—and that is the way we feel about BYD—we’re likely to be a little too loyal. I don’t think we’ll change on that.

查理·芒格:好吧,我很少持有比亚迪这样的公司,因为它的价格太高了,所以我认为我还没有一个系统。我只是边走边学。我想你可以相信这样一个事实:如果我们真的喜欢比亚迪,喜欢管理层,这就是我们对比亚迪的感觉,我们可能会有点过于忠诚。我想我们不会改变的。

Question: Why, almost two years ago, did you believe that Costco was the only U.S. stock worth buying? And why did you feel that Amazon had more to fear from Costco than Costco had to fear from Amazon? And if you believe Jeff Bezos is one of the best businessmen you have ever known, would you consider investing early in any of the new projects he will inevitably focus his attention on now that he will not have to be as concerned about the day to day responsibilities of Amazon?

问:近两年前,你为什么认为好市多是唯一值得购买的美国股票?为什么你觉得亚马逊对好市多的恐惧要多于好市多对亚马逊的恐惧?如果你相信杰夫·贝佐斯是你所认识的最优秀的商人之一,你会考虑尽早投资于任何一个新项目吗?他现在不可避免地会把注意力集中在这些项目上,因为他不必像以前那样关心亚马逊的日常责任?

Charlie Munger: I’m a great admirer of Jeff Bezos whom I consider one of the smartest businessmen who ever lived. But I won’t be following him. We have our crotchets and I just don’t know enough about it to want to go into that activity. When you get into these hard questions, there’s a lot of very intelligent honorable people who reach opposite conclusions.

查理·芒格:我非常崇拜杰夫·贝佐斯,我认为他是有史以来最聪明的商人之一。但我不会跟着他。我们有自己的胯部,我只是对它了解不够,不想参加那个活动。当你陷入这些棘手的问题时,会有很多非常聪明、值得尊敬的人得出相反的结论。

Costco I do think has one thing that Amazon does not. People really trust Costco will be delivering enormous value. And that is why Costco presents some danger to Amazon. They’ve got a better reputation for providing value than practically anybody, including Amazon.

我认为好市多有一件事是亚马逊没有的。人们真的相信好市多会带来巨大的价值。这就是为什么好市多给亚马逊带来了一些危险。他们提供价值的名声比任何人都好,包括亚马逊。

Question: How do you control your investments in a world where reasonable companies with a good image like General Electric sink rapidly into the bottomland of the stock market. How do you recognize a potential downfall in a company you hold/invest in? Or, is it impossible to realize a deterioration quickly enough to exit without a loss?

问:在一个像通用电气这样有良好形象的理性公司迅速陷入股市低谷的世界里,你如何控制自己的投资。你如何认识到你持有/投资的公司可能会垮台?或者,是不是不可能快速地实现恶化,从而在没有损失的情况下退出?

Charlie Munger: Well, I never owned a share of General Electric because I didn’t like the culture. And, I was not surprised when it blew up. I do think the present CEO is an extraordinarily able man and the directors made a very wise choice when they put him in charge. And I think the directors of GE deserve a lot of credit for making Larry Culp the CEO. If anybody can fix it, he can.

查理·芒格:嗯,我从未拥有通用电气的股份,因为我不喜欢这种文化。而且,当它爆炸的时候我并不惊讶。我确实认为现任的首席执行官是一个非常能干的人,董事们在任命他为主管时做出了非常明智的选择。我认为通用电气的董事们应该为拉里·卡普成为首席执行官而得到很多赞扬。如果有人能修好,他也能。

Question: You famously run investments through your mental checklist. Is there anything that you wish you had added to your checklist sooner?

问题:众所周知,你通过你的心理检查表进行投资。有什么你希望早点加入你的清单的吗?

Charlie Munger: Well, I’m constantly making mistakes where I can, in retrospect, realize that I should have decided differently. And I think that that is inevitable because it’s difficult to be a good investor.

查理·芒格:嗯,我经常犯错误,回想起来,我意识到我应该做出不同的决定。我认为这是不可避免的,因为很难成为一个好的投资者。

I’m pretty easy on myself these days. I’m satisfied with the way things have worked out and I’m not gnashing my teeth when other people are doing better.

这些天我对自己很好。我对事情的发展方式很满意,当别人做得更好的时候,我也不会咬牙切齿。

I think that the methods that I’ve used including the checklists are the correct methods and I’m grateful that I found them as early as I did and that the methods have worked as well as they have. I recommend that other people follow my example.

我认为我使用的方法包括检查表都是正确的方法,我很感激我早就找到了这些方法,而且这些方法也很有效。我建议其他人以我为榜样。

It reminds me of the key phrase and Bunyan’s Pilgrim’s Progress in which he says: My sword I leave to him who can wear it. I’m afraid that’s the way we all have to leave our swords.

这让我想起了班扬的《朝圣者的历程》中的一句话:我的剑留给了会佩剑的人。恐怕这就是我们离开剑的方式。

Question: You and Warren have been adept at quickly sizing people up, particularly business leaders and potential business partners. What do you look for in a leader? And do you and Warren have any tricks or shortcuts to size people up quickly and accurately?

问:你和沃伦擅长快速评估人员,特别是商业领袖和潜在的商业伙伴。你在领导者身上寻找什么?你和沃伦有什么诀窍或捷径来快速准确地衡量人吗?

Charlie Munger: Well, of course, if a person is a chronic drunk, we avoid him. Everybody has shortcuts to screen out certain hazards. And we probably have more of those shortcuts than others. They’ve served us well over the years.

查理·芒格:好吧,当然,如果一个人是个长期醉酒的人,我们会避开他。每个人都有排除某些危险的捷径。我们可能比其他人有更多的捷径。这些年来他们为我们服务得很好。

One of the great advantages of the way Berkshire operates is that we associate with a lot of marvelous people. And if you stop to think about it, that is also true at the Daily Journal.

伯克希尔运作方式的一大优势是,我们与许多了不起的人交往。如果你停下来想一想,日报上也是如此。

What little newspaper company has come through the crisis of this destroying of all the newspapers better than the little Daily Journal? And we’ve had marvelous people here to help us do it through very difficult times and one of them is Gerry Salzman.

有哪家小报社能比《小日报》更好地度过这场毁灭所有报纸的危机?我们这里有很多了不起的人帮助我们度过了非常困难的时期,其中之一就是格里·萨尔兹曼。

Gerry and I have been together, how many years Gerry?

格瑞和我在一起有多少年了?

Gerald Salzman: Early 70s.

杰拉尔德·萨尔兹曼:70年代初。

Charlie Munger: Early 70s. And it’s rather interesting. I recognized early that Gerry could run anything he wanted to run. And when the old CEO of the Daily Journal died, Gerry was managing the business affairs of the Munger Tolles law firm. But he previously worked for Rick Guerin and me in running a little mutual fund that we bought control of. And he made a very favorable impression.

查理·芒格:70年代初。而且很有趣。我很早就认识到格里可以跑任何他想跑的东西。当《每日邮报》的老首席执行官去世时,格瑞正在管理芒格托尔斯律师事务所的商业事务。但他之前曾为我和里克·盖林(Rick Guerin)工作,经营一家我们收购了控制权的小型共同基金。他给我留下了很好的印象。

I said to Rick, we’re going to make Gerry the head of the Daily Journal. He gasped and said, but he’s never had anything to do with newspapers or anything else. I said it won’t matter. He’ll be able to do it. And we immediately ascended, we put Gerry in, and he’s made every decision wonderfully ever since. That’s our system.

我对里克说,我们要让格瑞当日报的社长。他气喘吁吁地说,但他从来没有和报纸或其他任何东西有任何关系。我说了没关系。他会做到的。我们立刻提升,我们把格里放进去,从那以后他做了每一个奇妙的决定。这就是我们的系统。

Tom Murphy used to say that his system of management was to delegate just short of total abdication. And that’s the way we handled Gerry.

汤姆墨菲曾经说过,他的管理制度是授权,只是短期内完全放弃。我们就是这样对付格瑞的。

Question: Which do you think is crazier? Bitcoin at 50,000 or Tesla’s fully diluted enterprise value of 1 trillion. What do you make of these two pricings?

问:你觉得哪个更疯狂?5万比特币或特斯拉完全摊薄的1万亿企业价值。你怎么看这两个价格?

Charlie Munger: Well, I have the same difficulty that Samuel Johnson once had when he got a similar question. And he said; I can’t decide the order of presidency between a flee and a louse.

查理·芒格:嗯,我遇到的困难和塞缪尔·约翰逊遇到类似问题时遇到的一样。他说:我不能在逃亡和卑鄙之间决定总统职位的先后顺序。

I feel the same way about those choices. I don’t know which is worse.

我对这些选择也有同感。我不知道哪个更糟。

Question: Should there be a tax on buying stock now that Robinhood trades are free?

问:既然罗比尼奥的股票交易是免费的,是否应该对购买股票征税?

Charlie Munger: Robinhood trades are not free. When you pay for order flow, you’re probably charging your customers more and pretending to be free. It’s a very dishonorable low-grade way to talk. Nobody should believe that Robinhood’s trades are free.

查理·芒格:罗比尼奥的交易不是免费的。当你为订单流付费时,你可能会向你的客户收取更多的费用并假装是免费的。这是一种非常不光彩的低级谈话方式。没有人应该相信罗比尼奥的交易是自由的。

Question: My question concerns China. In 1860, GDP per capita in China was 600. In 1978, the year Deng Xiaoping took over, it was 300. Today, it hovers around 9500. Never before in the history of mankind have we seen such a rapid eradication of poverty, pulling approximately 800 million people out of destitution. You are on record as a zealous fan of the Chinese work ethic and Confucian value system. As we can see from the deteriorating U.S. relationship with China, the Western world does not understand China. What can we do to increase knowledge, understanding, and appreciation of the Chinese civilization?

问:我的问题涉及中国。1860年,中国人均国内生产总值为600美元。1978年,邓小平接任的那一年,是300人。今天,它徘徊在9500点左右。在人类历史上,我们从未见过如此迅速地消除贫穷,使大约8亿人摆脱贫困。你是中国职业道德和儒家价值体系的狂热粉丝。从美中关系的恶化可以看出,西方世界并不了解中国。我们能做些什么来增加对中华文明的认识、了解和欣赏?

Charlie Munger: Well, it’s natural for people to think their own civilization and their own nation are better than everybody else. But everybody can’t be better than everybody else.

查理·芒格:嗯,人们自然会认为自己的文明和国家比其他任何人都好。但不可能每个人都比别人好。

You’re right. China’s economic record among the big nations is the best that ever existed in the history of the world. And that’s very interesting.

你说得对。中国在大国中的经济记录是世界历史上最好的。这很有趣。

A lot of people assume that since England led the Industrial Revolution and had free speech early that free speech is required to have a booming economy as prescribed by Adam Smith. But the Chinese have proved that you don’t need free speech to have a wonderful economy. They just copied Adam Smith and left out the free speech and it worked fine for them.

许多人认为,自从英国领导了工业革命并很早就有了言论自由以来,正如亚当·斯密(Adam Smith)所规定的那样,经济繁荣需要言论自由。但中国人已经证明,拥有一个美好的经济并不需要言论自由。他们只是照搬了亚当·斯密,忽略了言论自由,这对他们来说很好。

As a matter of fact, it’s not clear to me that China would have done better if they’d copied every aspect of English civilization. I think they would have come out worse because their position was so dire and the poverty was so extreme, they needed very extreme methods to get out of the fix they were in. So I think what China has done was probably right for China and that we shouldn’t be so pompous as to be telling the Chinese they ought to behave like us because we like ourselves and our system. It’s entirely possible that our system is right for us and their system is right for them.

事实上,我并不清楚,如果中国复制了英国文明的方方面面,中国会做得更好。我认为他们会变得更糟,因为他们的处境如此悲惨,贫穷如此极端,他们需要非常极端的方法来摆脱困境。因此,我认为中国所做的对中国来说可能是正确的,我们不应该如此傲慢,以至于告诉中国人,他们应该像我们一样行事,因为我们喜欢自己和我们的制度。完全有可能我们的系统适合我们,他们的系统也适合他们。

Question: Mr. Munger is a champion of Chinese stocks. How concerned is he about Chinese government interference as seen recently with Ant Financial, Alibaba, and Mr. Jack Ma. What, for example, is to stop the Chinese government from simply deciding one day to nationalize BYD?

问:芒格先生是中国股市的冠军。他有多担心中国政府最近对蚂蚁金融、阿里巴巴和马云的干预。举个例子,是什么阻止中国政府有一天决定将比亚迪国有化?

Charlie Munger: Well, I consider that very unlikely. And, I think Jack Ma was very arrogant to be telling the Chinese government how dumb they were, how stupid their policies were, and so forth. Considering their system, that is not what he should have been doing.

查理·芒格:嗯,我认为这不太可能。而且,我认为马云非常傲慢地告诉中国政府他们是多么愚蠢,他们的政策是多么愚蠢,等等。考虑到他们的体制,这不是他应该做的。

I think the Chinese have behaved very shrewdly in managing their economy and they’ve gotten better results than we have in managing our economy. I think that that will probably continue.

我认为中国人在管理经济方面表现得非常精明,他们在管理经济方面取得了比我们更好的结果。我认为这种情况可能会继续下去。

Sure, we all love the kind of civilization we have. I’m not saying I wanted to live in China. I prefer the United States. But I do admire what the Chinese have done. How can you not? Nobody else has ever taken a big country out of poverty so fast and so on.

当然,我们都热爱我们的文明。我不是说我想住在中国。我更喜欢美国。但我确实钦佩中国人所做的一切。你怎么能不呢?从来没有人能如此迅速地使一个大国摆脱贫困。

What I see in China now just staggers me. There are factories in China that are just absolutely full of robots and are working beautifully.

我现在在中国看到的一切让我大吃一惊。在中国,有很多工厂里都是机器人,而且工作得很漂亮。

They’re no longer using peasant girls to beat the brains out of our little shoe companies in America. They are joining the modern world very rapidly and they’re getting very skillful at operating.

他们不再用农家女孩来敲打我们美国小鞋厂的脑袋了。他们很快就加入了现代社会,他们的操作技术也越来越熟练。

Question: It seems likely that the current Fed policy of keeping interest rates near zero will only exacerbate the income disparity in this country by benefiting those who own the financial assets. What do you think we can do to help those who are currently falling behind as a result of this pandemic?

问:目前美联储维持利率接近于零的政策似乎只会使拥有金融资产的人受益,从而加剧这个国家的收入差距。你认为我们能做些什么来帮助那些由于这次大流行而落在后面的人?

Charlie Munger: It’s hard to know what exact macroeconomic policy is correct. No one knows for sure just how much government intervention is wise and at what point the government should stop intervening.

查理·芒格:很难知道什么样的宏观经济政策是正确的。没有人确切知道政府干预多少是明智的,政府应该在什么时候停止干预。

I don’t think we have any great gift at making macroeconomic predictions. I think that to some extent the complaint about the rich getting richer as a result of the COVID panic is a misplaced concern. Nobody was trying to make the rich richer. We were trying to save the whole economy under terrible conditions. And I think, by and large, we made the most practical decisions that were available to us.

我认为我们在宏观经济预测方面没有什么天赋。我认为,在某种程度上,对富人因恐慌而变得更富有的抱怨是一种错误的担忧。没有人想让富人更富有。我们试图在恶劣的条件下拯救整个经济。我认为,总的来说,我们做出了最实际的决定。

We made the rich richer, not as a deliberate choice, but because it was an accidental byproduct of trying to save the whole civilization. And it was probably wise that we acted exactly as we did. It wasn’t some malevolence of the rich that caused it. It was an accident. And the next time around the poor will get richer faster than the rich. That thing circulates.

我们让富人变得更富有,不是故意的选择,而是因为这是试图拯救整个文明的意外副产品。我们完全照做可能是明智的。不是富人的恶意造成的。那是个意外。下一次穷人会比富人更富。那东西循环着。

Who gets rich faster by class is going to vary over time and I don’t think anybody should be too concerned by it. As a matter of fact, what happens is to make a nation rich, you need a free market system. And if you have a free market system that’s trying to get rich in the way recommended by Adam Smith, what happens is that it’s a very irritating system because the poverty that causes so much misery is also causing the growth that makes everybody get out of poverty. In other words, to some extent, it’s a self-correcting system. That makes the whole thing very awkward. And it’s a shame that the economics textbooks don’t emphasize how much a growing economy needs poverty in order to get out of poverty. If you try and reduce the poverty too much, it’s counterproductive. These are very difficult questions and most people assume that it’s simple. If we could make the world richer by just raising the minimum wage to $100,000 a second or something, of course we would do it but. But we can’t.

随着时间的推移,谁的致富速度会越来越快,我认为任何人都不应该太在意这个问题。事实上,要使一个国家富裕起来,就需要一个自由市场体系。如果你有一个自由市场体系,它试图以亚当斯密推荐的方式致富,那么它会是一个非常令人恼火的体系,因为造成如此多痛苦的贫困也会导致增长,使每个人都摆脱贫困。换句话说,在某种程度上,这是一个自我修正的系统。这让整件事很尴尬。令人遗憾的是,经济学教科书没有强调一个不断增长的经济体需要多少贫困才能摆脱贫困。如果你试图过多地减少贫困,那会适得其反。这些都是非常困难的问题,大多数人认为这很简单。如果我们能把最低工资提高到10万美元一秒或者别的什么,让世界变得更富裕,我们当然会这么做,但是。但我们不能。

Question: Mr. Munger recently raised the alarm about the level of money printing taking place. What are his thoughts on modern monetary theory?

问:芒格最近对印钞业的发展水平提出了警告。他对现代货币理论有何看法?

Charlie Munger: Modern monetary theory means that people are less worried about an inflationary disaster like Weimar Germany from government printing of money and spending it. So far the evidence would be that maybe the monetary modern monetary theory is right. Put me down as skeptical. I don’t know the answer.

查理·芒格:现代货币理论意味着人们不太担心魏玛德国这样的通货膨胀灾难,因为政府印钞和消费。到目前为止,证据可能是现代货币理论是正确的。把我当成怀疑论者。我不知道答案。

Question: The Federal Reserve appears to be supporting asset prices. Do you think this is a worthwhile policy objective given the effect it has on creating financial excesses and income inequality? What do you think the long-term consequences will be?

问:美联储似乎在支持资产价格。你认为这是一个有价值的政策目标,因为它会造成财政过度和收入不平等?你认为长期的后果会是什么?

Charlie Munger: Well, I don’t know how well the economy’s doing to work in the future. And I don’t think that we or the Daily Journal is getting ahead because we’ve got some wonderful macroeconomic insight.

查理·芒格:嗯,我不知道未来的经济状况如何。我不认为我们或《每日邮报》取得了进展,因为我们有一些极好的宏观经济见解。

I do think that I’m way less afraid of inequality than most people who are bleeding about it. I think that inequality is absolutely an inevitable consequence of having the policies that make a nation grow richer and richer and elevate the poor. So, I don’t mind a little inequality and what I notice is that the rich families generally lose their power and wealth—and pretty fast. So I don’t worry that the country is being ruined by a few people over getting ahead a little faster than the rest of us.

我确实认为,我对不平等的恐惧要比大多数为此流血的人小得多。我认为,不平等绝对是使一个国家变得越来越富裕、使穷人地位提高的政策的必然结果。所以,我不介意有一点不平等,我注意到的是,富裕家庭通常会很快失去权力和财富。所以我不担心这个国家会因为比我们其他人快一点而被一些人毁掉。

I think the Chinese were very smart. Imagine a bunch of Chinese communists turning a whole lot of Chinese and the billionaires in a big hurry. And what did the Chinese communists do with respect to death taxes? The death tax in China is zero. That’s what the communists are doing. I think they’re probably right, by the way.

我认为中国人很聪明。想象一下,一群中国共产党人匆匆忙忙地变成了一大堆中国人和亿万富翁。中国共产党对死亡税做了什么?中国的死亡税是零。共产党人就是这么做的。顺便说一句,我想他们可能是对的。

Question: Many believe that inequality accelerated by this pandemic has reached alarming levels that demand drastic solutions such as a wealth tax. Do you agree with the premise and if so how would you address inequality?

问题:许多人认为,这种流行病加剧的不平等已经达到了令人震惊的程度,需要采取严厉的解决办法,如征收财富税。你同意这个前提吗?如果同意,你会如何处理不平等问题?

Charlie Munger: I think any rich nation ought to have a social safety net that expands a little with its wealth. That’s what we’ve been doing throughout my whole lifetime. And I applaud the result. I think the result would have been worse if either party had been in control all by itself for the whole period. In other words, I think the system of checks and balances and elections that our founders gave us actually gave us pretty much the right policies during my lifetime. I hope that that will continue in the future. But I do think politics is getting more full of hatred and irrationality than it used to be in America and I don’t think that’s good.

查理·芒格:我认为任何一个富裕的国家都应该有一个社会安全网,用它的财富扩大一点。这就是我们一生都在做的。我为结果鼓掌。我认为,如果任何一方在整个时期都完全由自己控制,结果会更糟。换句话说,我认为我们的创始人给我们的制衡和选举制度实际上在我有生之年给了我们几乎正确的政策。我希望这种情况今后将继续下去。但我确实认为政治比过去在美国更加充满仇恨和非理性,我认为这不好。

Questions: Many major businesses and high net worth individuals have been leaving California. Can you speak to the causes, the trend, and make some predictions?

问题:许多大企业和高净值人士已经离开加州。你能谈谈原因,趋势,并作出一些预测吗?

Charlie Munger: Yes, I think that is rising as we sit here. I just see more and more of the rich people leaving. And, of course, I think it’s vastly stupid for any state to be user-friendly to the rich people. They do way more good than harm. They lose their money fast enough. You don’t need to worry about them.

查理·芒格:是的,我想当我们坐在这里的时候,这个数字正在上升。我只是看到越来越多的富人离开。当然,我认为任何一个州对富人友好都是非常愚蠢的。他们做的事利大于弊。他们很快就亏了钱。你不用担心他们。

Washington State is actually considering a wealth tax at the state level. I think that would be insanity. I predict that if they do that, a lot of people will leave Washington.

华盛顿州实际上正在考虑在州一级征收财富税。我觉得那太疯狂了。我预测如果他们那样做,很多人会离开华盛顿。

Question: With all the work from home with Zoom and other technology, what do you think the future of commercial real estate looks like?

问:在家里用Zoom和其他技术完成所有工作后,你认为商业地产的未来会是什么样子?

Charlie Munger: Real estate has always been a difficult field. And some types of real estate in recent years has been particularly difficult. I think office buildings are now in some trouble and, of course, commercial real estate rented to stores has been in a lot of trouble for a long time. Apartments have come through better. But, I don’t think I’ve got a lot to contribute. I own some apartment houses, so I like that investment, provided you’ve got a perfect management which is hard to get.

查理芒格:房地产一直是一个困难的领域。而一些类型的房地产在最近几年已经特别困难。我认为写字楼现在遇到了一些麻烦,当然,租给商店的商业地产早就遇到了很多麻烦。公寓的情况更好。但是,我想我没什么可以贡献的。我有一些公寓,所以我喜欢这项投资,只要你有一个完美的管理,这是很难得到的。

Question: I was wondering if you could share some thoughts on Haven, particularly why it was ultimately closed. What were the lessons learned?

问:我想知道你是否可以分享一些关于避风港的想法,特别是它最终关闭的原因。吸取了什么教训?

Charlie Munger: I don’t know anything about Haven. Give me a new question.

查理·芒格:我对哈文一无所知。给我一个新问题。

Question: You’ve said several times that the best way to learn about business is to study the multi-decade financial results of great companies. You’ve even said business schools that don’t adopt this method are doing their students a disservice. Would you mind elaborating on how a professor or individual should go about building a curriculum around this approach? What, for example, would you recommend as course materials?

问:你已经说过好几次了,学习商业的最好方法是研究大公司几十年的财务业绩。你甚至说过,不采用这种方法的商学院对他们的学生是一种伤害。你介意详细说明一下教授或个人应该如何围绕这一方法制定课程吗?例如,你会推荐什么作为课程材料?

Charlie Munger: Well, here’s what I meant. By the way, the Harvard Business School, when it started out way early, they started out with a history of the business. They’d take you through the building of the canals and the building of the railroads and so on and so on. You saw the ebb and flow of industry and the creative destruction of the economic changes and so on. It was a background that helped everybody. And, of course, what I’m saying is that if I were teaching business I would start the way Harvard Business School did a long time ago.

查理·芒格:我的意思是。顺便说一句,哈佛商学院起步很早的时候,他们一开始就有商业史。他们会带你穿过修建运河和铁路等等。你看到了工业的兴衰和经济变化的创造性破坏等等。这个背景对每个人都有帮助。当然,我想说的是,如果我教商业,我会像哈佛商学院很久以前那样开始。

I think they stopped because if you taught that course, you’d be stealing the best cases from the individual professors of marketing and so on and so on. And I just think it was academically inconvenient for them. But, of course, you should start out by studying the history of capitalism, how it worked, and why before you start studying business. And they don’t do that very well—I’m talking about the business schools.

我想他们停下来是因为如果你教这门课,你会从市场营销等各个教授那里窃取最好的案例。我只是觉得他们在学业上不太方便。但是,当然,在你开始学习商业之前,你应该先学习资本主义的历史,它是如何运作的,以及为什么。他们做得不太好——我说的是商学院。

If you stop to think about it, business success long term is a lot like biology. And in biology, what happens is the individuals all die, and eventually, so do all the species. Capitalism is almost as brutal as that. Think of what’s died in my lifetime. Just think of the things that were once prosperous that are now in failure or gone. Whoever dreamed when I was young that Kodak and General Motors would go bankrupt. You know, it’s just, it’s incredible what’s happened in terms of the destruction. Of course, that history is useful to know.

如果你停下来想一想,长期的商业成功很像生物学。在生物学中,个体都会死亡,最终,所有物种也会死亡。资本主义几乎就是这样残酷。想想我这辈子死了什么。想想那些曾经繁荣的东西,现在已经失败或消失了。我年轻时梦想柯达和通用汽车破产的人。你知道,这只是,这是令人难以置信的破坏方面发生的事情。当然,了解这段历史是有益的。

Question: [The questioner] quotes a commencement address you gave in 2007 at USC Law School. I’ll paraphrase here. If a civilization can progress only when it invents the method of invention, you can only progress when you learn the method of learning. I was very lucky. I came to law school having learned the method of learning and nothing has served me better in my long life than continuous learning. [The questioner] would like to know what Charlie’s method of learning is.

问题:[提问者]引用了你2007年在南加州大学法学院的毕业演说。我在这里解释一下。如果一个文明只有发明了发明的方法才能进步,那么你只有学会了学习的方法才能进步。我很幸运。我来到法学院是因为学到了学习的方法,在我漫长的一生中,没有什么比不断学习更好的了。[提问者]想知道查理的学习方法是什么。

Charlie Munger: I think I had the right temperament. When people gave me a good idea and I could see it was a good idea, I quickly mastered it and started using it for the rest of my life. You’d say that everybody does that in their education but I don’t think everybody does. It’s such a simple idea.

查理·芒格:我想我的气质是对的。当人们给了我一个好主意,我看到这是一个好主意,我很快就掌握了它,并开始用我的余生。你会说每个人在他们的教育中都这样做,但我不认为每个人都这样做。这主意真简单。

Without the method of learning, you’re like a one-legged man in an ass-kicking contest. It’s just not gonna work.

没有学习的方法,你就像一个踢屁股比赛的独腿男人。只是行不通。

Take Gerry. Do you think the Daily Journal would have hundreds of millions of marketable securities now if Gerry didn’t know how to learn something new? He didn’t know one damn thing about the Daily Journal when we made him head of it. But he knew how to learn what he didn’t know. Of course, that’s a useful thing. And by the way, I think it’s hard to teach. I think it’s just to some extent you either have it or you don’t.

以格里为例。你认为如果格瑞不知道如何学习新东西,《每日邮报》现在会有数亿种有价证券吗?当我们让他当头儿的时候,他一点都不懂日报。但他知道如何学习他不知道的东西。当然,这是一件有用的事情。顺便说一句,我觉得很难教。我想只是在某种程度上你要么有要么没有。

Questions: Why are some people incapable of learning new ideas and behaviors?

问题:为什么有些人不能学习新的思想和行为?

Charlie Munger: It’s partly culture but a lot of it is just born in and it’s a quirk. Some people have a natural trend toward good judgment, and with other people, their life is just a series of mistakes over and over again.

查理·芒格:这部分是文化的原因,但很多都是刚出生的,这是一种怪癖。有些人天生倾向于良好的判断力,而对于其他人来说,他们的生活只是一系列错误的重复。

Question: You have revised your famous talk on the standard causes of human misjudgment with considerable new material back in 2005. Now 16 years have passed. Is there any new material?

问:你在2005年用大量新材料修改了关于人类错误判断标准原因的著名演讲。16年过去了。有新材料吗?

Charlie Munger: No, I would say that… of course, there’s some new material in misjudgment. But, but by and large, most of the knowledge has been available for a long time.

查理·芒格:不,我会说……当然,误判中有一些新材料。但是,总的来说,大部分知识已经存在很长时间了。

What prevents the wide use of helpful psychological insight is the fact that psychology gets really useful when you integrate it with all other knowledge. But they don’t teach that in the psychology department because the academic system rewards little experiments that develop more insight into psychological tendencies instead of synthesizing what’s already been discovered with the rest of knowledge. The psychology professors don’t know all that much about the rest of knowledge and they have no incentive to master it. If you don’t have master the rest of the knowledge you can’t synthesize it with psychology. That’s an interesting example of self-learning.

阻碍有用的心理学洞察力被广泛使用的是,当你把心理学与所有其他知识结合起来时,它会变得非常有用。但他们在心理学系不教授这一点,因为学术体系奖励的实验很少,这些实验可以培养对心理倾向的更多洞察,而不是将已经发现的知识与其他知识综合起来。心理学教授对其他知识不太了解,他们也没有动力去掌握。如果你没有掌握其余的知识,你就不能把它与心理学结合起来。这是自学的一个有趣的例子。

When I saw that psychology was necessary and I didn’t have it, I didn’t just learn the little tendencies well enough to get A’s in psychology. I learned those tendencies well enough to synthesize it with the rest of knowledge. And that’s the right way to do it. But show me a psychology department that knows how to do that. It’s one of the most ignorant professions in the world.

当我看到心理学是必要的,而我没有心理学的时候,我并没有把这些小倾向学得足够好,从而在心理学上得了A。我把这些倾向学得很好,足以把它和其他知识结合起来。这是正确的方法。但给我看一个心理学系知道怎么做。这是世界上最无知的职业之一。

Question: Charlie, you are known as an advocate for learning from one’s mistakes. What can you learn from the Barry “Dutton’s” bookstore building deal in Brentwood and how would you apply that new knowledge or experience in the future?

问题:查理,大家都知道你提倡从错误中吸取教训。你能从巴里“达顿”在布伦特伍德的书店建筑交易中学到什么?你将如何在未来应用这些新知识或经验?

Charlie Munger: I think I’ve learned to avoid zoning work. When I was young, I rezoned some properties very successfully. And I was like Rip Van Winkle; when I tried to come back to it, I found that the world had changed. And I don’t think you’ll find me engaged in the massive rezonings in the future.

查理·芒格:我想我已经学会了避免分区工作。当我年轻的时候,我非常成功地重新划分了一些房产。我就像瑞普·范·温克尔,当我试图回到过去时,我发现世界已经改变了。我不认为你会发现我在未来从事大规模的重新分区。

Question: What advice would you give to someone who is trying to stay within their circle of competence but finding that the pace of technical technological innovation is rapidly reducing that circle?

问题:如果有人试图保持在自己的能力范围内,但发现技术创新的速度正在迅速缩小这个范围,你会给他什么建议?

Charlie Munger: Well, of course, if they bring in a brand new technology you don’t understand at all, you’re at something of a disadvantage. And my advice would be if you have a fixable disadvantage, remove it. And if it’s unfixable, learn to live without it. What else can you do?

查理·芒格:好吧,当然,如果他们引进一种你根本不懂的全新技术,你就处于不利地位。我的建议是,如果你有一个可以弥补的缺点,就把它去掉。如果它是不可弥补的,学会没有它的生活。你还能做什么?

You fix what you can fit, and what you can’t fix, you endure.

你能修的修,修不好的修,你就忍。

Question: You are one of the oldest and greatest thinkers of our time. Any tips for someone who wants to work on and improve their ability to hold two opposing views at the same time? Any tips on how to generate insight in these types of situations?

问:你是我们这个时代最古老、最伟大的思想家之一。对于那些想同时处理和提高持有两种对立观点能力的人,有什么建议吗?关于如何在这种情况下产生洞察力有什么建议吗?

Charlie Munger: Well, I do have a tip. At times in my life, I have put myself to a standard that I think has helped me: I think I’m not really equipped to comment on this subject until I can state the arguments against my conclusion better than the people on the other side. If you do that all the time; if you’re looking for disconfirming evidence and putting yourself on a grill, that’s a good way to help remove ignorance.

查理·芒格:嗯,我确实有个建议。在我的生活中,有时我会把自己置于一个我认为对我有帮助的标准之下:我认为在我能够比另一方的人更好地陈述反对我结论的论点之前,我还没有能力对这个问题发表评论。如果你一直这样做;如果你在寻找不确定的证据,把自己置于烤架上,那是帮助消除无知的好方法。

What happens is that every human being tends to believe way more than he should in what he’s worked hard to find out or where he’s announced publicly that he already believes. In other words, when we shout our knowledge out, we’re really pounding it out. We’re not enlarging it. And, I was always aware of that and so I’ve accepted these damned annual meetings. I’ve been pretty quiet.

所发生的事情是,每个人都倾向于比他应该相信的更多地相信他努力去发现的东西,或者他公开宣布他已经相信的东西。换言之,当我们大声说出我们的知识时,我们实际上是在把它敲出来。我们不会扩大的。而且,我一直都意识到这一点,所以我接受了这些该死的年度会议。我一直很安静。

Question: Eugene Abegg seems like he was one of the best bankers of the last century, achieving both extremely low loan loss rates and earning around 2% on assets over a long time period. I think the bankers of today could learn a lot from Eugene, but little is known of him. How did Eugene achieve incredibly low loan losses over the long term while so many other bankers have failed miserably?

问:尤金·阿贝格似乎是上个世纪最优秀的银行家之一,他在很长一段时间内实现了极低的贷款损失率和2%左右的资产收益。我认为今天的银行家可以从尤金身上学到很多东西,但对他了解甚少。尤金是如何在这么多其他银行家惨败的情况下,实现难以置信的长期低贷款损失的?

Charlie Munger: Well that’s an easy one. He was a very smart man. He lived in a particular town. He knew everybody and everything. He had excellent judgment. He cared terribly about not making bad loans or incurring dumb expenses. So he was just a perfect banker if you wanted never to have any trouble.

查理·芒格:这很简单。他是个非常聪明的人。他住在一个特定的城镇。他认识每一个人和每一件事。他有很好的判断力。他非常关心不发放坏账或不招致愚蠢的开支。如果你不想惹麻烦的话,他就是个完美的银行家。

Of course, it really helped to know everybody in town. If I had stayed in Omaha, where I was raised, and gotten into the banking business, I would have been a hell of a good banker. Because even as a boy, I knew a lot about who was sound who wasn’t sound in Ohama. And that’s the way Eugene was in his community.

当然,认识镇上的每个人真的很有帮助。如果我留在奥马哈,在那里我长大,并进入银行业,我会是一个很好的银行家地狱。因为即使在我还是个孩子的时候,我就知道很多关于在Ohama谁是健全的谁不是健全的。尤金在他的社区就是这样。

Furthermore, he’d gone through the Great Depression. He’d been a receiver for a bank. Of course, that made him very leery of dumb loans. And, of course, he hated costs. He was just a very old-fashioned sound thinker.

此外,他还经历了大萧条。他曾是一家银行的接管人。当然,这让他对愚蠢的贷款非常警惕。当然,他讨厌成本。他只是一个非常守旧的健全的思想家。

Of course, that will still work. But it’s hard for anybody. He really knew everything you had to do to avoid credit losses in a small town in Illinois.

当然,这仍然有效。但对任何人来说都很难。他真的知道在伊利诺伊州的一个小镇上,为了避免信用损失你必须做的一切。

Question: Charlie, you have been a long-time admirer of Singapore and Lee Kuan Yew. You once said to study the life and work of Lee Kuan Yew. You are going to be flabbergasted. I would be curious to know how you started your interest in Singapore and Lee Kuan Yew. Have you met Lee Kuan Yew in person? And if there is one thing the world could learn from Singapore, what would that be?

问:查理,你一直以来都是新加坡和李光耀的崇拜者。你曾经说过要研究李光耀的生活和工作。你会大吃一惊的。我很想知道你是如何开始对新加坡和李光耀感兴趣的。你见过李光耀本人吗?如果世界能从新加坡学到什么,那会是什么?

Charlie Munger: Well, Lee Kuan Yew had the best record as a nation builder. If you’re willing to count small nations in the group, he had probably the best record that ever existed in the history of the world. He took over a malarial swamp with no army, no nothing. And, pretty soon, he turned that into this gloriously prosperous place.

查理·芒格:嗯,李光耀在建国方面有着最好的记录。如果你愿意把小国家也算进去的话,他可能是世界历史上最好的记录。他没有军队,什么也没有,占领了疟疾沼泽。很快,他就把这里变成了一个富丽堂皇的地方。

His method for doing it was so simple. The mantra he said over and over again is very simple. He said, figure out what works and do it. Now, it sounds like anybody would know that made sense. But you know, most people don’t do that. They don’t work that hard at figuring out what works and what doesn’t. And they don’t just keep everlastingly at it the way he did.

他的方法很简单。他反复说的咒语很简单。他说,找出有效的方法,然后去做。现在,似乎任何人都知道这是有道理的。但你知道,大多数人不会这么做。他们不会那么努力地去弄清楚什么是有效的,什么是无效的,他们也不会像他那样一直坚持下去。

He was a very smart man and he had a lot of good ideas. He absolutely took over a malarial swamp and turned it into modern Singapore—in his own lifetime. It was absolutely incredible.

他是个非常聪明的人,有很多好主意。在他有生之年,他完全接管了一片疟疾沼泽地,把它变成了现代的新加坡。简直难以置信。

He was a one party system but he could always be removed by the electorate. He was not a dictator. And he was just so good. He was death on corruption which was a very good idea. There’s hardly anything he touched he didn’t improve.

他是一个一党制的人,但他总能被选民罢免。他不是独裁者。他真是太棒了。他因腐败而死,这是个好主意。他几乎没有碰过什么东西,也没有改善。

When I look at the modern Singapore health system, it costs 20% of what the American system costs. And, of course, it works way better than our medical system. That’s entirely due to the practical talent of Lee Kuan Yew. Just time after time, he would choose the right system.

当我看看现代的新加坡医疗体系时,它的成本是美国医疗体系成本的20%。当然,它比我们的医疗系统更有效。这完全归功于李光耀的实践才能。一次又一次,他会选择正确的制度。

In Singapore, you get a savings account the day you’re born. If you don’t spend the money, you and your heirs get to spend it eventually. In other words, it’s your money. So, to some extent, everybody buying medical services in Singapore is paying for it themselves. Of course, people behave more sensibly when they’re spending their own money.

在新加坡,你出生的那天就有一个储蓄账户。如果你不花这笔钱,你和你的继承人最终会花掉的。换句话说,这是你的钱。所以,在某种程度上,每个在新加坡购买医疗服务的人都是自己买单的。当然,人们在花自己的钱时表现得更理智。

Just time after time he would do something like that. That recognized reality and worked way better than what other people were doing. There aren’t that many people like Lee Kuan Yew that have ever lived. So, of course, I admire him. I have a bust of Lee Kuan Yew in my house. I admire him that much.

一次又一次他会做那样的事。他们认识到了现实,比其他人做得更好。像李光耀这样生活过的人并不多。所以,我当然佩服他。我家里有李光耀的半身像。我真佩服他。

Question: What is the biggest lie currently being perpetuated by the investment complex?

问:投资综合体目前最大的谎言是什么?

Charlie Munger: Well, commission-free trading is a very good candidate for that if you want to emphasize disgusting-wise. Commission-free trading is not free.

查理·芒格:好吧,如果你想强调恶心的智慧,免佣金交易是一个很好的选择。免佣金交易不是免费的。

Question: Do you think it’s best to invest in the common stocks of businesses early or while they are more nascent and the industry is smaller, or wait until they are the clear winner of a more mature industry?

问:你认为最好是尽早投资于企业的普通股,还是趁着企业比较新生、行业规模较小的时候投资,或者等到它们成为一个更成熟行业的明显赢家时再投资?

Charlie Munger: I think Warren and I are better at buying mature industries than we are at backing startups like Sequoia. The best venture capital operation probably in the whole world is Sequoia’s and they are very good at this early stage investing. I would hate to compete with Sequoia in their field. I think they’d run rings around me.

查理·芒格:我认为沃伦和我更擅长收购成熟的行业,而不是支持红杉这样的初创公司。全世界最好的风险投资运营可能是红杉,他们在早期投资阶段非常出色。我不想在他们的领域和红杉竞争。我想他们会围着我转。

So, I think for some folks, early-stage investing is best, and for other folks, what I’ve done in my life is best.

所以,我认为对一些人来说,早期投资是最好的,而对其他人来说,我一生所做的是最好的。

Question: Last year, almost every ecommerce, internet, and internet adjacent stock was up 100 plus percent. You’ve said recently that Sequoia is the greatest investment firm ever. Do you think that digital economy has reached a tipping point such that this time is different and that conventional valuation measures for these types of companies are dead, or does this environment remind you of 1999? How do you reconcile the idea of paying 50 or 60 times revenue for a growing but unprofitable business with the more traditional value investing concept of a margin of safety?

问:去年,几乎所有电子商务、互联网和互联网相关的股票都上涨了100%以上。你最近说过红杉是有史以来最伟大的投资公司。你认为数字经济已经到了一个转折点,这一次不同了,这类公司的传统估值方法已经过时了,还是这种环境让你想起了1999年?你如何将为一个不断增长但无利可图的业务支付50倍或60倍收入的想法与更传统的安全边际价值投资概念相协调?

Charlie Munger: Well, generally speaking, I don’t try and compete with Sequoia. You can argue that I got close to Sequoia when with Li Lu we bought into BYD. That was not a startup, but it was so small and thinly traded that we were buying into a venture capital type investment but in the public market.

查理·芒格:嗯,一般来说,我不想和红杉竞争。你可以说,我和李璐一起收购比亚迪时,就和红杉关系密切。那不是一家初创公司,但规模很小,交易量很小,我们购买的是一种风险投资类型的投资,但是在公开市场。

With that one exception, I’ve stayed out of Sequoia’s business because they’re so much better at it than I would be and I don’t know how to do it the way they do it.

除了这一个例外,我一直不参与红杉的业务,因为他们比我更擅长这项业务,我不知道如何用他们的方式来做。

Question: Of the various types of moats and competitive advantages, which types do you think will be most important in the years ahead, and what combinations of competitive advantages can you imagine will create any new types of moats?

问:在各种类型的护城河和竞争优势中,您认为哪些类型的护城河在未来几年最为重要,您能想象哪些竞争优势的组合会创造出新的护城河类型?

Charlie Munger: That’s too hard in general a question for me. The one thing I will say is that a lot of the moats that looked impassable, people found a way to displace. Think of all the monopoly newspapers that used to be, in effect, part of the government of the United States. And they’re all dying—every damn one of them almost. A lot of the old moats are going away, and, of course, people are creating new moats all the time. That’s the nature of capitalism. It’s like evolution in biology.

查理·芒格:这个问题对我来说太难了。我要说的一件事是,许多看起来不可逾越的护城河,人们找到了一种方法来取代。想想那些过去实际上是美国政府一部分的垄断报纸吧。他们几乎都要死了。许多旧的护城河正在消失,当然,人们一直在创造新的护城河。这就是资本主义的本质。就像生物学中的进化。

New species are created and old species are dying. Of course, it’s hard to negotiate in such a field. But there’s no rule that life has to be easy on the mental side. Of course, it’s going to be difficult.

新物种被创造,旧物种正在死亡。当然,在这样的领域很难谈判。但是没有规定生活在精神方面必须是轻松的。当然,这会很困难。

Question: I enjoyed your Caltech interview and wanted you to elaborate and provide more insights on your point of great investors and great chess players. How are they similar or different? Have you seen the television show Queen’s Gambit on Netflix?

问:我很喜欢你对加州理工学院的采访,希望你详细阐述并提供更多关于你的观点,即伟大的投资者和伟大的棋手。它们有什么相似或不同之处?你看过Netflix上的电视节目《女王的游戏》吗?

Charlie Munger: I have seen an episode or two of the Queen’s Gambit.

查理·芒格:我看过一两集女王的花招。

What I think is interesting about chess is, to some extent, you can’t learn it unless you have a certain natural gift. And even if you have a natural gift, you can’t be good at it unless you start playing at a very young age and get huge experience. So, it’s a very interesting competitive field.

我认为国际象棋有趣的是,在某种程度上,除非你有某种天赋,否则你是学不来的。即使你有天赋,你也不可能擅长它,除非你在很小的时候就开始打球并获得丰富的经验。所以,这是一个非常有趣的竞争领域。

I think people have the theory that any intelligent hardworking person can get to be a great investor. I think any intelligent person can get to be pretty good as an investor and avoid certain obvious traps. But I don’t think everybody can be a great investor or a great chess player.

我认为人们有这样的理论:任何聪明勤奋的人都可以成为一个伟大的投资者。我认为任何一个聪明的人都可以成为一个很好的投资者,避免某些明显的陷阱。但我不认为每个人都能成为一个伟大的投资者或一个伟大的棋手。

I knew a man once, Henry Singleton, who was not a chess champion. But he could play chess blindfolded at just below the Grandmaster level. But Henry was a genius. And there aren’t many people that can do that. And if you can’t do that, you’re not gonna win the great chess championships of the world and you’re not gonna do as well in business as Henry Singleton did.

我曾经认识一个人,亨利·辛格尔顿,他不是国际象棋冠军。但他可以在略低于大师水平的水平下蒙着眼睛下棋。但亨利是个天才。能做到这一点的人并不多。如果你做不到这一点,你就不会赢得世界象棋锦标赛的冠军,你也不会像亨利·辛格尔顿那样在生意上做得那么好。

I think some of these things are very difficult and I think, by and large, it’s a mistake to hire investment management—to hire armies of people to make conclusions. You’re better off concentrating your decision power on one person the way the Li Lu partnership does and then choose the right person.

我认为其中有些事情非常困难,而且我认为,总的来说,雇佣投资管理人员来雇佣一大群人来做结论是错误的。你最好把你的决定权集中在一个人身上,就像李路合伙企业那样,然后选择合适的人。

I don’t think it’s easy for ordinary people to become great investors.

我认为普通人要成为伟大的投资者并不容易。

Question: You identified the opportunity in electrification and invested in BYD. How do you think about the hydrogen opportunity for transportation and how does it compare to the electric opportunity, specifically thinking about trucks versus cars. Will we have fewer gas stations or truck stops in the future?

问:你发现了电气化的机会,并投资了比亚迪。你如何看待氢的运输机会,以及它与电力的机会相比,特别是考虑卡车与汽车。将来加油站和卡车站会更少吗?

Charlie Munger: Well, I hope we don’t have fewer truck stocks because Berkshire Hathaway is deeply involved in truck stops. But, of course, I think there will be more automation in transportation of all kinds in the future.

查理·芒格:好吧,我希望我们的卡车库存不会减少,因为伯克希尔·哈撒韦公司深深地卷入了卡车停摆。但是,当然,我认为将来各种运输都会更加自动化。

I don’t think I’ve got any great insight about hydrogen. But I do think having a whole system to sell hydrogen is difficult. On the other hand, the buses in Los Angeles work on natural gas. All the buses. And it has saved Los Angeles a fortune because gas is so much cheaper than gasoline. I’ve seen the whole bus system shift from gasoline or diesel to gas and so it obviously isn’t impossible, but you’d have to create a whole new system of supply for it.

我想我对氢没有什么深刻的见解。但我确实认为要有一个完整的系统来销售氢气是很困难的。另一方面,洛杉矶的公共汽车使用天然气。所有的公共汽车。它还为洛杉矶省下了一大笔钱,因为汽油比汽油便宜得多。我看到整个公交系统从汽油或柴油转向汽油,所以这显然不是不可能的,但你必须为它建立一个全新的供应系统。

I don’t even know how much more difficult—or how much more dangerous—it would be to deal with hydrogen than it is to deal with gasoline which is also a dangerous substance.

我甚至不知道处理氢气比处理汽油更困难,也更危险,汽油也是一种危险物质。

You’ve reached the limit of my circle of competence. I can’t help you.

你已经到了我能力范围的极限了。我帮不了你。

Question: What would management [of Daily Journal] do with a sudden windfall of profits? How would they think about current opportunities with low rates and low inflation?

问:【日报社】的管理层会如何处理突然暴利?他们如何看待当前低利率和低通胀的机遇?

Charlie Munger: Well, it’s not easy to handle accumulated money in the current environment when these stocks are so high and partials of real estate of certain kinds are also very inflated. So it’s very difficult. And all I can say is that we’ll do the best we can.

查理·芒格:好吧,在目前的环境下,当这些股票如此之高,而且某些种类的房地产价格也非常膨胀时,处理累积的资金并不容易。所以很难。我只能说我们会尽最大努力。

When it gets difficult, I don’t think there’s any automatic fix for difficulty. I think when difficulty comes, I expect to have my share.

当它变得困难时,我不认为有任何自动解决困难的办法。我想当困难来临时,我会有我的份。

Question: Does management, in your opinion, have a moral responsibility to have their shares trade as close to fair value as possible?

问:在你看来,管理层是否有道德责任让他们的股票交易尽可能接近公允价值?

Charlie Munger: I don’t think you can make that a moral responsibility. Because if you do that, I’m a moral leper. The daily journal stock sells way above the price I would pay if I was buying new stock. So, no I don’t think it’s the responsibility of management to assure where the stock sells.

查理·芒格:我认为你不能把这当成一种道德责任。因为如果你那样做,我就是道德麻风病人。日刊股票的价格比我买新股票要高很多。所以,不,我不认为管理层有责任确保股票在哪里卖出。

I think management should tell it like it is at all times and not be a big promoter of its own stock.

我认为管理层应该一直这样告诉它,而不是成为自己股票的大推动者。

Question: In 1999, the year the Daily Journal bought Sustain Technologies, the traditional business employed 355 full-time employees and 61 part-time employees. In 2010, that was down to 165 full-time employees and 15 part-time employees. This year’s annual report suggests that the traditional business has 97 full-time employees. Has the quality of the publication suffered as the employment levels have decreased? Or, has the digital revolution caused enormous productivity improvements in those businesses?

问:1999年,《每日日报》收购了Sustain Technologies,这家传统企业雇佣了355名全职员工和61名兼职员工。2010年,这一数字下降到165名全职员工和15名兼职员工。今年的年报显示,这家传统企业有97名全职员工。随着就业水平的下降,出版物的质量是否受到影响?或者,数字革命是否导致了这些企业生产力的巨大提高?

Charlie Munger: Well, of course, the places downsized. They had to because the traditional business newspaper business is shrinking. Gerry, being a sound thinker, you know, did the very unpleasant work of shrinking it appropriately without bothering me or Rick. It showsed how wise we were to put him there in the first place.

查理·芒格:嗯,当然,这些地方被缩小了。他们不得不这样做,因为传统的商业报纸业务正在萎缩。格瑞,作为一个健全的思想家,你知道,做了一个非常不愉快的工作,适当地缩小它,而不打扰我或里克。这说明我们当初把他放在那里是多么明智。

Has the quality gone down? Well, I don’t think the quality of publishing public notice advertising has gone down. But, I hardly think the editorial quality could go way up when employees were going down. My guess is we have suffered some editorial quality. Gerry, you have a comment on that?

质量下降了吗?嗯,我不认为发布公告广告的质量下降了。但是,我几乎不认为在员工人数减少的情况下,编辑的质量会大大提高。我猜我们的编辑质量有所下降。格瑞,你对此有何评论?

Gerald Salzman: There are a number of factors that come into play here. And you mentioned technology—that’s very, very important. Many of our systems are in the cloud. All except for the legal advertising system which we had to build because nobody else has the volume that we have. Our editorial system and our advertising system are all in the cloud. Accounting is also in the cloud.

杰拉尔德·萨尔兹曼:这里有很多因素在起作用。你提到了非常非常重要的技术。我们的许多系统都在云中。除了我们必须建立的合法的广告系统,因为没有人拥有我们拥有的数量。我们的编辑系统和广告系统都在云端。会计也在云端。

The disruption from the decline in newspapers has had a significant impact. Classified advertising is down significantly. In display advertising, for example, we now utilize a very friendly company that worked with us for 25 years and now they are helping us sell advertising.

报纸数量下降造成的混乱产生了重大影响。分类广告大幅下降。例如,在展示广告方面,我们现在利用了一家与我们合作了25年的非常友好的公司,现在他们正在帮助我们销售广告。

Also, fortunately before the pandemic, we got out of the conference-type events and we were not subjected to the problems of no conferences nobody to attend.

此外,幸运的是,在大流行之前,我们摆脱了会议式的活动,没有遇到没有人参加会议的问题。

When you look at what’s happened in California [in terms of] the price of real estate and rentals, we’ve reduced the number of offices we have both for Journal Technology and for the Daily Journal. It’s very difficult to hire reporters in the San Francisco area with all the demands coming from the internet companies wanting to have an editorial product.

当你看看加州房地产价格和租金的变化时,我们已经减少了《技术日报》和《每日邮报》的办公室数量。在旧金山地区雇用记者是非常困难的,因为所有的要求都来自希望有一个编辑产品的互联网公司。

All those factors come into play and if you go back a little further, we eliminated California Lawyer magazine and we had one time a newspaper in Seattle and one in Denver. At about the same time, we bought a newspaper in Phoenix and that worked out extremely well. It’s difficult to break into the legal advertising system which supports so many newspapers, not only in California but elsewhere.

所有这些因素都发挥了作用,如果你再往前看一点,我们淘汰了加州律师杂志,我们有一次在西雅图和丹佛的报纸。大约在同一时间,我们在凤凰城买了一份报纸,效果非常好。很难打入支持这么多报纸的合法广告系统,不仅在加利福尼亚州,而且在其他地方。

Charlie Munger: It’s very hard to have a shrinking business. Gerry has done magnificently well. It was totally required.

查理·芒格:生意萎缩是很难的。格里做得非常好。这是完全必要的。

Question: Do you believe the market is going through a long-term value slump similar to 1999, or do you believe technology has caused a permanent change in how companies should be valued?

问:你认为市场正在经历一场与1999年类似的长期价值暴跌,还是认为科技已经导致企业估值方式的永久性改变?

Charlie Munger: I don’t know how permanent it’s going to be but it certainly caused a change.

查理·芒格:我不知道它会持续多久,但它确实引起了变化。

Of course, it’s hard to know what the future holds when in a complex system where you can’t predict a lot of things. Generally, what people do is they have financial reserves so they have some options if trouble comes, and they adapt the way Gerry has to require downsizings or require upsizings.

当然,在一个你无法预测很多事情的复杂系统中,很难知道未来会怎样。一般来说,人们所做的是,他们有财政储备,所以如果遇到麻烦,他们有一些选择,他们适应格瑞的方式,要求裁员或要求加薪。

One of the interesting things about the Daily Journal is that we made all that money in the foreclosure boom. So we were like an undertaker who suddenly got prosperous in a plague year. It’s a funny way to make money. That happened because Gerry and I bought these little newspapers all over the state just as a precaution to make sure we could serve public notice advertising wherever it arose in the state.

《每日邮报》有趣的一点是,我们在止赎热潮中赚了那么多钱。所以我们就像一个殡仪馆老板,在一个瘟疫年突然变得繁荣起来。这是一种有趣的赚钱方式。之所以会这样,是因为我和格瑞在全州买了这些小报纸,以防万一,以确保我们可以在全州出现的任何地方提供公告广告。

That turned out to be a wonderful idea and that’s one of the reasons we made all this money. So, the shareholders have been lucky to have somebody like Gerry here who could learn what he didn’t know and fix it.

这是个好主意,也是我们赚这么多钱的原因之一。所以,股东们很幸运,有一个像格里这样的人在这里,他可以学到他不知道的东西,并解决它。

Question: You’ve spent much of your life contributing your wisdom to schools and hospitals. How would you advise these institutions to manage their endowments over the coming decades?

问:你一生中的大部分时间都在为学校和医院贡献你的智慧。你会如何建议这些机构在未来几十年管理它们的捐赠?

Charlie Munger: Well, the one charitable institution where I have had some influence for a very long time has a whole bunch of hotshot financiers in every branch of wealth management there is on the board. And that institution has two assets in its endowment account. One is a big interest in Li Lu’s China fund, which is a limited partnership, and the other is a Vanguard index fund. As a result of holding those two positions, we have a lower cost than anybody else and we make more money than practically everybody else. So you now know what I do in charitable institutions.