Li Lu’s talk at Columbia 2006

李录在哥伦比亚大学2006年的演讲

Li Lu is a possible Berkshire Hathaway CIO candidate. Tariq Ali (The Street Capitalist) recently posted his notes from Lu’s lecture at Columbia in 2006.

李录可能是伯克希尔哈撒韦首席信息官候选人。塔里克·阿里(街头资本家)最近贴出了2006年卢在哥伦比亚大学演讲的笔记。

Li Lu

李录

![图片[1]_李录在哥伦比亚大学2006年的演讲_繁木网](http://fanmu.com/wp-content/uploads/2021/11/liluzhaopian.jpg)

This past weekend was the Berkshire Hathaway (NYSE:BRK.A / BRK.B) annual shareholder meeting. At one point during the Q&A, a questioner asked Warren Buffett about the status of Berkshire’s CIO candidates. Charlie Munger remarked that one candidate who he is particular close with was up 200% in 2009 with 0 leverage. Some people think that the person Munger is referring to is Li Lu, a fund manager who turned Munger and Buffett onto BYD.

上周末是伯克希尔哈撒韦公司(纽约证券交易所:BRK.A/B)年度股东大会。在问答环节,一位提问者曾向沃伦•巴菲特(warrenbuffett)询问伯克希尔首席信息官候选人的状况。查理·芒格说,一位与他关系特别密切的候选人在2009年以零杠杆率上涨了200%。有人认为芒格指的是李路,一位将芒格和巴菲特转投比亚迪的基金经理。

Lu personally owns at least 2% of BYD, which rose 400% in 2009. I don’t know anything about his investments beyond that one position, but I know he is a huge believer in taking concentrated, high conviction positions. If that is the case here, BYD’s spectacular results must have contributed a lot to his returns for 2009 which may make a 200% for the year possible.

李录个人持有比亚迪至少2%的股份,2009年比亚迪股价上涨了400%。我不知道他在这一职位之外的投资情况,但我知道他非常相信能够集中精力、高度自信地进行投资。如果是这样的话,比亚迪的惊人业绩肯定对他2009年的回报做出了很大贡献,这可能使今年的回报率达到200%。

Here is a brief bio on Lu:

以下是关于录的简介:

Li Lu was born in China in 1966. He attended Nanjing University in China and later came to the U.S., and earned three degrees (BA, JD, MBA) simultaneously from Columbia University. After graduation, he worked in an investment bank until 1997, when he founded Himalaya Capital Management, which today manages both LL Investment Partners and Himalaya Capital Ventures, funds focused on publicly traded securities and venture capital. Li Lu was named a global leader for tomorrow by the World Economic Forum in 2001, and a Henry Crown fellow by the Aspen Institute in 1998. He is a member of Council on Foreign Relations and Young Presidents’ Organization.

李录1966年出生在中国。他曾就读于中国南京大学,后来来到美国,并同时获得了哥伦比亚大学的三个学位(学士、法学博士、工商管理硕士)。毕业后,他一直在一家投资银行工作,直到1997年,他创立了喜马拉雅资本管理公司(Himalaya Capital Management),该公司如今管理LL investment Partners和Himalaya Capital Ventures,这两家基金专注于上市证券和风险投资。2001年,李录被世界经济论坛(World Economic Forum)提名为“明日全球领袖”,1998年被阿斯彭研究所(Aspen Institute)提名为亨利•克朗(Henry Crown)研究员。他是外交关系委员会和青年总统组织的成员。

Fortune: Barnstorm Green

财富:谷仓风暴绿

There isn’t a whole lot of information about Lu’s investing style out there. But I thought I would share some notes from a lecture he gave to Columbia Business School back in 2006. All of this is paraphrased, so don’t take anything as a direct quote and there may even be some inaccuracies. Still, I believe you will find these notes insightful, especially with respect to improving your own abilities as an analyst and investor. Even if Lu is not a Berkshire Hathaway CIO candidate, he is an investor with a tremendous work ethic that we could all learn from.

关于李录的投资风格的信息并不多。但我想我会分享他2006年给哥伦比亚商学院的一次演讲的一些笔记。所有这些都是转述,所以不要把任何东西作为直接引用,甚至可能有一些不准确的地方。不过,我相信你会发现这些笔记很有见地,特别是在提高你作为分析师和投资者的能力方面。即使卢不是伯克希尔-哈撒韦首席信息官的候选人,他也是一个拥有巨大职业道德的投资者,我们都可以从中学习。

Below are my notes from Lu’s lecture:

下面是我在录的讲座中的笔记:

Li Lu at Columbia Business School – 2006

2006年哥伦比亚商学院李录

– 15 years ago, Lu was accidentally brought in to a lecture by Warren Buffett. Had epiphany moment, Lu thought he could do something in the investment business.

-15年前,录意外地被沃伦•巴菲特(warrenbuffett)讲座吸引。有了顿悟的一刻,录觉得自己可以在投资行业有所作为。

– At the time, Lu had just escaped China. Did not know very many people. No money, deep in debt. Worried about making a living in the US.

-当时,录刚离开中国。不认识很多人。没钱,债台高筑。担心在美国谋生。

– In the middle of Buffett speech, made him think differently about the stock market.

-在巴菲特演讲的中途,让他对股市有了不同的思考。

– The more Lu thought about it, the more he thought it was something he could do.

-录越想越觉得这是他能做的事情。

– Value investors see themselves as owners of a business. Therefore, fortunes are up and down with the nature of the business.

-价值投资者将自己视为企业的所有者。因此,财富随着企业的性质而上下波动。

– You demand a margin of safety.

-你要求有安全边际。

3 Traits of a Value Investor:

价值投资者的3个特征:

1. Basically, you don’t think of yourself as a paper shuffler who constantly buys and sells securities. You think of yourself as a real owner of the business.

1.基本上,你不会认为自己是一个不断买卖证券的纸牌洗牌者。你认为自己是企业的真正主人。

2. You only own a small piece of the business, so you demand a huge margin of safety.

2.你只拥有一小部分业务,所以你要求有巨大的安全边际。

3. Because you think of yourself as an owner, not trading all the time, you think everyone else is different — like Ben Graham’s Mr. Market

3.因为你认为自己是一个拥有者,不是一直在交易,你认为其他人都是不同的——就像本·格雷厄姆的《市场先生》

On Value Investing

论价值投资

– Under 5% of all assets are run under value investors, a real minority in the investment world.

-在所有资产中,有不到5%的资产由价值投资者管理,而价值投资者在投资界只占少数。

– The stock market is created for the other 95% of people, that is where your opportunity and challenge is.

-股市是为其他95%的人创造的,这就是你的机会和挑战所在。

– That was one lesson that stuck in Lu’s mind when listening to Buffett’s lecture.

-这是录在听巴菲特讲课时,脑海中萦绕的一课。

– Biggest challenge: understand whether you are the 5% or the 95%

-最大的挑战:了解你是5%还是95%

– It is tempting to do what the other 95% of people do. Emotionally very difficult to be in the 5%, but value investors typically have better returns. The money is really for traders and they tend to amass more assets.

-像其他95%的人那样做是很诱人的。在情感上很难达到5%,但价值投资者通常有更好的回报。这些钱实际上是给交易员的,他们往往会积累更多的资产。

– 5% have a spectacular return, but 95% of money probably always resides to somewhere else.

-5%的人有着惊人的回报,但95%的钱可能总是存在于其他地方。

– Understand who you are. You will be tested. You will have to ask yourself whether you are or aren’t a value investor.

-明白你是谁。你将接受考验。你必须扪心自问,你是不是一个价值投资者。

– If you are a value investor, you are probably genetically mutated and comfortable being in the minority. This is unnatural to human beings. You have to be comfortable being by yourself. You have to adopt the idea that you are right because your reason and evidence, not because others agree with you.

-如果你是一个价值投资者,你很可能是基因突变和舒适的少数。这对人类来说是不自然的。你一个人呆着要舒服。你必须接受这样的观点:你是对的,是因为你的理由和证据,而不是因为别人同意你。

– You will probably spend most of your time being an academic researcher rather than a professional. You are a researcher or journalist, with insatiable curiosity. You are trying to figure out how everything works.

-你可能会把大部分时间花在学术研究上,而不是专业人士上。你是一个研究人员或记者,有着永不满足的好奇心。你想弄清楚一切是怎么运作的。

– The more you know, the better you are as an investor.

-你知道的越多,你作为一个投资者就越好。

– Politics, science, technology, literature, poetry, everything can affect businesses and help you.

-政治、科学、技术、文学、诗歌,一切都能影响企业,帮助你。

– Occasionally you can find insights that will give you tremendous insights that other people don’t have.

-偶尔你会发现一些别人没有的深刻见解。

– Then you find if the business is cheap. Is the management good? What else? Why is the opportunity there?

-然后你会发现生意是否便宜。管理好吗?还有什么?为什么会有机会?

– Started fund in late 1997. Been through really traumatic events: Asian Financial Crisis, Tech Bubble.

-于1997年底成立。经历过非常痛苦的事件:亚洲金融危机,科技泡沫。

– Fall of 1998: Lu’s search process is very general. Got hooked on value line, loved to read the whole thing from beginning to end. The best kind of education, you should do this if you want encyclopedic knowledge of companies. Go through it page after page, it is enormously helpful.

-1998年秋天:录的搜索过程非常普遍。迷上了价值观,喜欢从头到尾阅读整件事。最好的教育方式是,如果你想对公司有全面的了解,就应该这样做。一页一页地浏览,这是非常有帮助的。

– First thing Lu checks is new low list. New low P/Es, P/Bs, etc.

-录首先检查的是新低名单。新低市盈率、市盈率等。

– Does not care where something traded before.

-不在乎以前在哪里交易的东西。

– First looks at valuation. If the valuation doesn’t fit, doesn’t go beyond it.

-首先看估值。如果估值不合适,就不要超越它。

– If you see a low P/B ratio, ask – What is in the book? How much is the book?

-如果你发现市盈率很低,问问——书上写的是什么?这本书多少钱?

– Encyclopedic knowledge is helpful when looking across different industries.

-百科全书式的知识有助于跨越不同的行业。

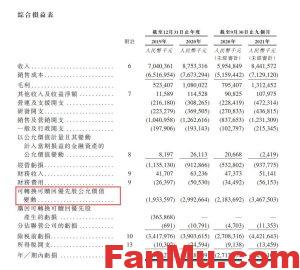

– Look at pre-tax and pre-interest earnings. Look from an un-leveraged basis. Figure out how much capital is deployed in the business. Look at ROIC.

-看看税前和息税前收入。从非杠杆基础上看。计算出企业中部署了多少资本。看看ROIC。

Example: Timberland

例如:Timberland

– Start by giving a 5 second look at the business. Timberland. The business is trading around clean book value, consisting mostly of tangible liquid assets, working capital, plus 100M in real estate. Deployed capital is 200M with 100M return.

-先看5秒钟的业务。Timberland。这家公司的交易以净账面价值为基础,主要包括有形流动资产、营运资本以及1亿不动产。部署资金200米,回报100米。

– Then check why the business fell apart and became cheap. Think if you had owned the entire business at that price.

-然后看看为什么生意会分崩离析,变得便宜。想想如果你以这个价格拥有了整个公司。

– At the time, was the height of the Asian Financial Crisis, saw their sales falling off the cliff in Asia. Any thing with exposure to Asia was falling apart. Try to check what other people are thinking about this. You may not listen to their advice but you may want to know what other people are looking at.

-当时,正是亚洲金融危机最严重的时候,他们在亚洲的销量跌入了悬崖。任何与亚洲有关的事情都在分崩离析。试着看看其他人是怎么想的。你可能不听他们的建议,但你可能想知道别人在看什么。

– Timberland had no other analysts covering it.

-Timberland没有其他分析师报道此事。

– Why no coverage?

-为什么没有保险?

– Look at business across years. Timberland has been growing, pretty profitable, did not need financial markets. Family owned. Owns 40% controlling 98% vote.

-看看这些年的生意。Timberland一直在增长,利润可观,不需要金融市场。家族所有。拥有40%的股份和98%的投票权。

– Immediately, that is a turnoff to most people. You can do a quick data search.

-很快,大多数人都会对此感到厌烦。你可以做一个快速的数据搜索。

– You need to have a curious, active mind to ask questions and find answers.

-你需要有一个好奇的,积极的头脑来提问和寻找答案。

– Timberland had most of the vote, no analyst coverage, a bunch of shareholder lawsuits. If you were a member of the other 95% of the investment business you might say maybe management is milking the business.

-Timberland获得了大部分选票,没有分析师的报道,还有一大堆股东诉讼。如果你是其他95%的投资企业的一员,你可能会说管理层在挤奶。

– Download every court document lawsuit. Read it. You NEED a very curious mind to figure out WHAT is happening. Dig every single time. READ EVERYTHING.

-下载所有诉讼文件。读一下。你需要一个非常好奇的头脑来弄清楚发生了什么。每次都挖。什么都读。

– The first time, it takes a couple minutes to look over financials. Then gather questions and do deep research.

-第一次,我们花了几分钟的时间来审视财务状况。然后收集问题并进行深入研究。

– Most lawsuits came from Timberland missing guidance, annoying investors, which annoyed the owner of the business. They decided to stop talking to Wall Street. So it was not about milking the business or fraud. They were not crooks.

-大多数的诉讼都来自于Timberland缺少指导,惹恼了投资者,惹恼了企业的所有者。他们决定停止与华尔街的对话。因此,这不是挤奶的业务或欺诈。他们不是骗子。

– How do you determine if they are good managers? Decent people?

-你如何判断他们是否是优秀的管理者?体面的人?

– Act like an investigative journalist. Most business owners leave a trail for you to follow and see how they deal with different situations. Most professional managers would not see this as part of their job, but YOU are part of their 5%.

-表现得像个调查记者。大多数企业主都会给你留下一条线索,让你了解他们如何处理不同的情况。大多数职业经理人不会将此视为他们工作的一部分,但你是他们5%工作的一部分。

– Go to their community, visit people they know, their Church, their Synagogue, introduce yourself to their friends and neighbors. It is worth it to spend as much time as possible, to find what these business people have done and what their neighbors say about them to accurately get an idea of their personality.

-去他们的社区,拜访他们认识的人,他们的教堂,他们的犹太教堂,向他们的朋友和邻居介绍自己。花尽可能多的时间,找出这些商人做了什么,他们的邻居对他们的评价,从而准确地了解他们的个性,这是值得的。

– The father seemed like a simple, decent guy, just a high school graduate. the son went to business school, was already COO of the company even though he was Lu’s age. Lu saw what boards the son sat on, and noticed that they had a mutual friend. Managed to get himself on the board with the son and became friends quickly. Came to realize these where high quality, very ethical businessmen.

-父亲看起来是一个简单,体面的人,只是一个高中毕业生。儿子上的是商学院,已经是公司的首席运营官了,尽管他和录的年龄相仿。录看到儿子坐在什么木板上,注意到他们有一个共同的朋友。他设法和儿子一起上了董事会,很快就成了朋友。认识到这些高质量,非常有道德的商人。

– After all that, saw the stock was still trading low. Decided he did not miss anything. The other 95% may not have done enough research to see this or have some kind of institutional imperative that prevents them from owning.

-在这一切之后,我看到该股仍在低位交易。决定他没有错过任何东西。另外95%的人可能没有做足够的研究来了解这一点,或者有某种制度上的强制要求阻止他们拥有。

– If you are not a good analyst, you will never be a good investor.

-如果你不是一个好的分析师,你就永远不会是一个好的投资者。

– But we decide to buy. How much do we buy? Imagine having $900. The other 95% will take tiny positions, 50 basis points. You need to use concentration, a $200 position. Think of how much work you did. Lu visited all the stores to see how margins improved – they had a fad going on where kids wanted the shoes. Their asian business is tiny, reduced earnings by less than 5%.

-但我们决定买。我们买多少?想象一下有900美元。另外95%的人将采取微小的立场,50个基点。你需要集中注意力,200美元的位置。想想你做了多少工作。录参观了所有的商店,看看利润率是如何提高的——他们在孩子们想要鞋子的地方掀起了一股热潮。他们在亚洲的业务规模很小,收入减少了不到5%。

– Lu put a ton into Timberland. What happened after next 2 years? Stock went up 700%. Propelled by earnings. No real risk – went from trading at 5x earnings to 15x with earnings growing 30% a year. It adds up.

-录把一吨粮食投进了Timberland。两年后发生了什么?股票上涨了700%。受收入推动。没有真正的风险-从5倍的收益交易到15倍的收益,每年增长30%。总而言之。

Be a Learning Machine

成为学习机器

– When an investment opportunity comes, you have to seize it. Devote day and night so you can act quickly. Do everything complete but do it fast. You have to train yourself to jump on opportunity.

-当一个投资机会来临时,你必须抓住它。日以继夜地投入,这样你才能迅速行动。做每件事都要完成,但要快。你必须训练自己抓住机会。

– When opportunity presents itself you can smell it. The only way to do that is by training yourself and reading page after page of financial report.

-当机会出现时,你能闻到它。唯一的办法就是训练自己,阅读一页又一页的财务报告。

– Uses S&P manuals for viewing foreign stocks.

-使用标准普尔手册查看外国股票。

– As an owner, don’t think about per share information.

-作为所有者,不要考虑每股信息。

– Use your brain, when looking at stock manuals, each page should really only take 5 minutes. Don’t use calculators. Use mental math.

-动动脑筋,看股票说明书时,每一页实际上只需要5分钟。不要使用计算器。使用心算。

Example: Korean Company

例如:韩国公司

– 60M market cap, pre-tax earnings of 31M, roughly 2x pre-tax earnings.

-6000万市值,3100万税前收益,约为税前收益的2倍。

– Book value of 230M, what constitutes book value? If you are an owner, look at: fixed assets, working capital, don’t count on goodwill.

-账面价值2.3亿,什么构成账面价值?如果你是一个所有者,看看:固定资产,营运资金,不要指望商誉。

– Basically you see with 60M in market cap, 30M in pre-tax, $240M in book value ($180M in fixed assets)

-基本上你可以看到,6000万市值,3000万税前,2.4亿账面价值(1.8亿固定资产)

– It might be cheap.

-可能很便宜。

– Determine what the earnings is. The book. The working capital.

-确定收益是多少。这本书。营运资金。

– Use common sense, common logic and think about the business.

-运用常识、常识和逻辑思考业务。

– Most employees never went to business school, Lu finds they are easier to train.

-大多数员工从未上过商学院,录发现他们更容易接受培训。

– Of the 70M in current assets, it is all cash

-在7000万流动资产中,全部是现金

– Of 180M in fixed assets, they own 100% of a hotel, recorded 30M as book. Own 13% of a department store recorded as 30M.

-在1.8亿固定资产中,他们拥有一家酒店100%的股份,账面价值为3000万英镑。拥有一家百货公司13%的股份,据记录为3000万英镑。

– Look up the department store, it roughly has a market cap of 600M. 13% gives you roughly 80M. So the book value undervalues it by another 50M.

-看看百货公司,它的市值大概是6亿美元,13%的市值大概是8000万美元,所以账面价值又低估了5000万美元。

– They own 15% of 3 cable companies and a whole bunch of real estate.

-他们拥有3家有线电视公司15%的股份和一大堆房地产。

– The department store has exactly the same profile. Trading roughly around cash and investments, good earnings, and own a whole bunch of assets. Turns out they are the second largest cable operator as well

-这家百货公司的情况完全一样。交易大致围绕现金和投资,良好的收益,并拥有一大堆资产。原来他们也是第二大有线电视运营商

– The department store operates like a hotel, do not take inventory, more like a shopping mall.

-百货公司的运作就像一个酒店,不去盘点,更像一个购物中心。

– They charge a percentage on the top line of all merchant sales.

-他们在所有商家的销售额中按百分比收费。

– Put it all together: Paying 60M, 70M in net cash, another 100M in stock, 30M in hotel with a value that has not been changed in last 10 years while real estate market has gone up in 10 years. Went to Korea, looked at hotel and department stores.

-总的来说:支付6000万,7000万的现金净额,1亿的股票,3000万的酒店价值在过去10年里没有改变,而房地产市场在10年里一直在上涨。去了韩国,看了酒店和百货公司。

– Checked recent transaction of properties in neighborhood, value is likely 2-3x what is on the book. But take what is on the book anyway, add 150M. Add that to rest and you get 320M in assets that you are paying 60M for and earning 30M annually from operations.

-查看附近最近的房产交易,价值可能是账面价值的2-3倍。但不管怎么说,拿账面上的数字来说,再加上1.5亿美元,剩下的就有3.2亿美元的资产,你要为此支付6000万美元,每年从运营中赚取3000万美元。

– Insiders own 50%

-内部人士持股50%

– Many factors going in your favor, but you need to look at how local investors see it. They need to be buying it for the price to go up.

-很多因素对你有利,但你需要看看当地投资者是怎么看的。他们需要买它,价格才会上涨。

– Department store used to trade at 22 went to 100

-百货公司以前的交易价格是22比100

– This company was at 12 now trades around 70

-这家公司当时只有12家,现在交易量在70家左右

– each went up 5-6x

-每个价格都上涨了5-6倍

Don’t just listen. Do it.

别只是听着。去做吧。

– This type of an approach is not natural to an investor.

-这种方法对投资者来说并不自然。

– If you decide your personality fits in with the mutated gene pool, that this is something you might be looking to do, there is a lot of money in it — proven by Ben Graham to Buffett

-如果你决定你的个性与变异基因库相吻合,这可能是你想要做的事情,其中有很多钱——本·格雷厄姆向巴菲特证明了这一点

– You have to put in a lot of work into your analysis.

-你必须在分析中投入大量的精力。

– You can make a lot of money if you are really interested, listening, and actually DOING IT.

-如果你真的感兴趣,认真听,并且真的去做,你可以赚很多钱。

– Lu benefited from listening to his value investing class and then actually going out and doing the work required.

-卢受益于听他的价值投资课程,然后实际出去做工作要求。

– Value investing is not really about theory, it is about what works.

-价值投资不是理论问题,而是什么是有效的。

– Young analysts have energy and nothing to lose, so they should go and do the work.

-年轻的分析师精力充沛,没有什么可失去的,所以他们应该去做这项工作。

– Before you become a good investor, you need to be a good analyst.

-在你成为一个好的投资者之前,你需要成为一个好的分析师。

Lu says you need two things to be a good analyst:

卢说,要成为一名优秀的分析师,你需要两件事:

1. Provide accurate and complete information. You have to go to an extra length to get it done. Most of the time you will stand alone against everybody else. If you are not competent about what you know, you cannot possibly take conviction positions when things go into free fall and everybody else is laughing at you.

1.提供准确、完整的信息。你得多走一段路才能完成。大多数时候,你会独自面对别人。如果你不能胜任你所知道的,你就不可能采取坚定的立场,当事情陷入自由落体,其他人都在嘲笑你。

2. Most money is not made in stocks from the examples. They do not provide out-sized returns. You can do the Tweedy Brown/Graham or the Buffett/Munger school. Your returns will come from a handful of stocks. You need tremendous insight by continuous intense curiosity and study.

2.从例子中可以看出,大多数钱不是从股票中赚来的。他们不提供超出规模的回报。你可以选择特威迪·布朗/格雷厄姆或巴菲特/芒格学校。你的回报将来自少数股票。你需要通过持续强烈的好奇心和学习获得巨大的洞察力。

Investment Mistakes

投资失误

– Most mistakes come from inaccurate or incomplete information.

-大多数错误来自不准确或不完整的信息。

– Biggest mistake: most people wanted 2 week or monthly returns. They wanted to go up in down markets.

-最大的错误:大多数人想要2周或每月的回报。他们想在低迷的市场中走高。

– Lu’s biggest mistake was straying, was working with Julian Robertson, started shorting — have to think like a trader when you are shorting because your downside can be unlimited. It’s like Charlie Munger says — having your hands tied behind your back while getting into a fight.

-录最大的错误是跑偏,与朱利安·罗伯逊合作,开始做空——做空时必须像交易员一样思考,因为你的下行空间是无限的。就像查理·芒格说的-在打架的时候双手被绑在背后。

– Missed the opportunity to buy a business below cash, even though Lu knew the management and had great insights. The business subsequently went up 50-100x. Could not bring himself to buy it because of his mindset at the time.

-尽管录了解管理层并有很强的洞察力,但他还是错过了用现金收购一家企业的机会。后来生意涨了50-100倍,由于当时的心态,他没能买下来。

– You make a mistake when you have not finished your work but like it enough. You start betting on probabilities instead of real analysis.

-如果你还没有完成工作,但却喜欢它,那你就犯了错误。你开始赌概率而不是真正的分析。

Constantly search for ideas

不断寻找想法

– In your life, you may only have 5-10 key moments of insight. You only get it from continuous learning. Find an American business and then find the Asian counterpart. Some businesses studied for 15 years. You need to know what that business is, how it ticks, so you can swing with conviction. If you cannot do that you will not make huge out-sized returns.

-在你的生活中,你可能只有5-10个关键时刻的洞察力。你只有不断学习才能得到。找一家美国公司,然后找一家亚洲公司。有些企业学习了15年。你需要知道那是什么生意,它是如何运作的,这样你才能坚定地摇摆。如果你不能做到这一点,你将不会取得巨大的规模回报。

– If you do what Ben Graham or Tweedy Brown does, you will make 15-20% returns but you wont make the huge returns of Buffett.

-如果你像本·格雷厄姆或特威迪·布朗那样做,你将获得15-20%的回报,但你不会获得巴菲特那样的巨额回报。

– The biggest ideas can give 10,000x returns.

-最大的创意可以带来10000倍的回报。

– Opportunities are not easy to find. They require a lot of factors to come together – Charlie Munger’s lollapalooza. You need a whole bunch of things working together where you have the insight and are willing to bet.

-机会不容易找到。他们需要很多因素结合在一起-查理芒格的lollapalooza。你需要一大堆的东西一起工作,你有洞察力,并愿意打赌。

– This is what drives Lu in business.

-这就是路在商业上的驱动力。

– Lu started in physics, mathematics, law, economics, got interested in other subjects. Wife has a PhD in biology, he has learned a lot from her.

-录开始学物理、数学、法律、经济学,对其他学科感兴趣。妻子是生物学博士,他从她身上学到了很多东西。

– Learn from everything, be intensely curious

-从一切中学习,保持强烈的好奇心

– Eventually you will stumble into one big opportunity.

-最终你会遇到一个大好机会。

– In the meantime, you will stumble into Timberland style investments which aren’t bad.

-与此同时,你会跌跌撞撞地进入林地式的投资,这并不坏。

– There might be years without opportunities, then years with a lot of opportunities.

-可能有几年没有机会,然后是几年有很多机会。

– Depends on what becomes available to you.

-取决于你能得到什么。

– They do not come in a steady pace, not like once a week an idea.

-他们不是以稳定的步伐来的,不像一周一次的想法。

– In 6 years, Lu had maybe 3-4 great ideas. But you get progressively better and better, improving the amount of opportunities for you since you will be quicker at your analysis.

-在6年的时间里,卢有3-4个伟大的想法。但是你会越来越好,因为你的分析会越来越快,你的机会也会越来越多。

– Go through every day by learning something. In a year you have to learn a great deal.

-通过学习来度过每一天。一年之内你必须学到很多东西。

– When Lu reads biology, physics, history, it is all searching for ideas. If one idea jumps out, it is all Lu does. Rest of the time is spent with wife and kids and Lu learns from them too, especially with seeing how human cognition develops which is enormously important.

-当录读生物学、物理学、历史时,都是在寻找思想。如果有一个想法突然出现,那就是录所做的一切。剩下的时间都花在妻子和孩子身上,卢也从他们身上学到了很多东西,尤其是观察人类认知的发展,这一点非常重要。

Li Lu’s Investing Checklist:

李录的投资清单:

1. Is that cheap?

1.便宜吗?

2. Is it a good business?

2.生意好吗?

2. Who is running it?

2.谁在管理?

3. What did I miss?

3.我错过了什么?

-Lu goes through the checklist, ‘what did I miss’ is greatly affected by psychology. This kind of cognition happens early on and Lu learns it from interacting with his girls.

-吕仔细看了一下清单,“我错过了什么”很大程度上受心理影响。这种认知很早就发生了,卢从和女儿们的交往中学到了这一点。

Three characteristics of a value investor:

价值投资者的三个特征:

1. Business owner mentality

1.企业主心态

2. Difference in time horizon

2.时差

3. Demand a huge margin of safety

3.要求巨大的安全边际

Think like a Business Owner

像企业主一样思考

– It all comes from one thing, that you are a business owner. You cannot force management changes, so you demand a margin of safety. You have a long time horizon because you think like an owner.

-这一切都来自一件事,你是一个企业主。你不能强迫管理层改变,所以你需要一个安全边际。你有一个很长的时间范围,因为你像一个所有者一样思考。

– But why dabble with stock market? Stock markets are made for people who can dream. That is why 95% of people never buy into value investing. Human nature prevents it.

-但为什么要涉足股市呢?股票市场是为有梦想的人创造的。这就是为什么95%的人从不购买价值投资。人性阻止了它。

– You do not belong to the stock market but you have to understand its perspective to position yourself properly. If you are truly think like a business owner, you will eventually leave the asset management business and run a real company. That is why Buffett and Munger left it.

-你不属于股票市场,但你必须了解它的观点,以正确定位自己。如果你真的像一个企业主一样思考,你最终会离开资产管理业务,经营一家真正的公司。这就是巴菲特和芒格离开的原因。

– Or you become a private equity investor.

-或者你成为私人股本投资者。

– The people who the stock market is designed for are fundamentally flawed people. Traders are bound to make mistakes due to fear or greed. They will always make room for value investors.

-股票市场的设计对象是有根本缺陷的人。由于恐惧或贪婪,交易者必然会犯错误。它们总会为价值投资者腾出空间。

– Used to be strict about selling with great business. Now, sometimes Lu feels he has insights about the business that allows him to believe the probabilities are in his favor for the business actually improving year after year.

-以前对销售很严格,生意很好。现在,有时卢觉得他对公司有深刻的见解,这让他相信公司年复一年的发展是有利于他的。

– That is the law of distribution in good businesses. The leaders perform spectacularly well.

-这就是好企业的分配规律。领导们表现得非常出色。

– Selling makes you pay a huge amount of tax and you might not get that good buying price again.

-卖东西要交一大笔税,你可能再也得不到那个好价钱了。

– If a business can generate 50-100% ROIC, the mathematics get interesting very quickly.

-如果一个企业能够产生50-100%的ROIC,那么数学很快就会变得有趣。

– Caveat: you have to be very confident. Investment bankers use BS and project into infinity. You cannot project that long. There are only a few opportunities where you can project that long.

-警告:你必须非常自信。投资银行家使用BS和项目进入无限。你不能投射那么长时间。只有少数几个机会,你可以项目那么长。

– If you are good, and spend your entire lifetime studying, across 50 year career maybe 5-10 opportunities where you can confidently project the next 10-20 years. At that point, you don’t want to sell. By holding you don’t pay the tax on capital gains, so you are really compounding 40% interest free, the business is deploying the capital at 40-100% a year in a tax efficient manner. That is what you do.

-如果你很好,并且用一生的时间学习,在50年的职业生涯中,可能有5-10个机会,你可以自信地预测未来10-20年。到那时,你就不想卖了。通过持有你不支付资本利得税,所以你实际上是复利40%免息,企业是部署资本在40-100%一年在一个节税的方式。你就是这么做的。

– You have to identify businesses that are getting stronger and stronger every year.

-你必须确定那些每年都在变得越来越强大的企业。

– What makes one business more successful than others? Why are they making more and more money compared to others?

-是什么让一个企业比其他企业更成功?为什么他们比别人赚的钱越来越多?

– The only way you can find that is by studying the ones that are established.

-你能找到的唯一方法就是研究那些已经建立起来的。

– Look for great businesses, not just businesses owned by Warren Buffett

-寻找伟大的企业,而不仅仅是沃伦•巴菲特(warrenbuffett)拥有的企业

Example of a great business: Bloomberg LP

伟大企业的例子:彭博社

– Product was superior to others, high switching costs

-产品优于其他产品,转换成本高

– Bloomberg is a fabulous case study, it came out of no where.

-彭博社是一个极好的案例研究,它从哪里冒出来的。

– Gained market share little by little, crossed a milestone point, became a monopoly

-一点一点地获得了市场份额,跨过了一个里程碑,成为了垄断企业

– At a certain point, after being highly relied upon for daily work, the switching costs become to high so winner takes all.

-在某种程度上,在日常工作高度依赖之后,转换成本变得很高,所以赢家通吃。

– Suppose you have an opportunity to see how an industry evolves early on. At a certain point they cross the line

-假设你有机会看到一个行业在早期是如何发展的。在某一点上他们越过了界限

– Maybe when introduced to all businesses. There is a time when that line gets crossed and a public company is poised to benefit by becoming a monopoly business.

-也许当介绍给所有企业时。有一段时间,当这条线被越过,上市公司准备成为一个垄断企业受益。

– Why did Microsoft succeed over Apple? Little by little they eroded Apple’s 100% market share.

-为什么微软战胜了苹果?它们一点一点地侵蚀了苹果100%的市场份额。

– Offices were using Windows. Today – do you have a choice of not using Bloomberg?

-办公室用的是窗户。今天-你有选择不使用彭博社吗?

– Bloomberg visits almost every month and asks what you do, how you use the system. Bloomberg terminals have tens of thousands of functions, they don’t give you a manual

-彭博社几乎每个月都会访问,询问你做什么,如何使用这个系统。彭博终端有上万种功能,他们不会给你一本手册

– They want you visually hooked so it is a behavioral connection and you don’t mind paying tens of thousands of years where you don’t have a choice if they raise prices

-他们想让你在视觉上上钩,所以这是一种行为上的联系,你不介意付出几万年,如果他们提高价格,你没有选择

– They keep coming back to you because they know you are a trader and want to provide you with more services so you are hooked.

-他们不断地回来找你,因为他们知道你是一个交易者,想为你提供更多的服务,所以你上钩了。

– That is why Bloomberg is a fabulous business because you get hooked. Think about switching from that or a competitor coming up with a rival product. How do you compete with that?

-这就是为什么彭博是一个神话般的业务,因为你会上瘾。想一想从这一点或竞争对手提出一个竞争对手的产品。你如何与之竞争?

– Lu doesn’t know. Suppose you know the inflexion point. Do you want to invest? Lu would invest in Bloomberg at that point.

-陆不知道。假设你知道拐点。你想投资吗?卢展工届时将投资彭博社。

– You need insight. Study every business. They all have more or less this type of dynamic.

-你需要洞察力。研究每一项业务。他们或多或少都有这种动力。

– Your job as a good financial analyst is to study that business ALL THE TIME. Observe those trends.

-作为一名优秀的金融分析师,你的工作就是一直研究这项业务。观察这些趋势。

– Once in your life, maybe you will find that opportunity.

-在你的一生中,也许你会找到机会。

– Why doesn’t Bloomberg want to sell? He doesn’t need to sell.

-为什么彭博社不想出售?他不需要卖东西。

– When you have a business like that, you don’t need to sell.

-当你有这样的生意,你不需要卖。

– Lu has made many private investments, ex: CapitalIQ, which copies Bloomberg’s business model. Same method with an investment in an engineering service.

-卢展工进行了许多私人投资,例如:复制彭博商业模式的CapitalIQ。工程服务投资的方法也是一样的。

– Lu likes to know as much as he can. He likes to be friends with people, with Timberland, the CEO and his son actually became investors in Lu’s fund.

-录喜欢尽可能多地了解。他喜欢与人交朋友,与天伯兰一起,这位CEO和他的儿子实际上成了陆兆禧基金的投资者。

– You can learn and observe from everyday business decisions and learn dynamics.

-你可以从日常的商业决策中学习和观察,学习动态。

– Nothing is constant. Everything is changing that is why you have to keep learning.

-没有什么是不变的。一切都在改变,所以你必须不断学习。

– Businesses change, Microsoft has threats now.

-业务发生变化,微软现在面临威胁。

– You need an active mind, so you are prepared to act and you can seize opportunity due to your insights.

-你需要一个积极的头脑,所以你准备行动,你可以抓住机会,由于你的见解。

暂无评论内容